- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

Business News of Saturday, 27 June 2015

Source: GNA

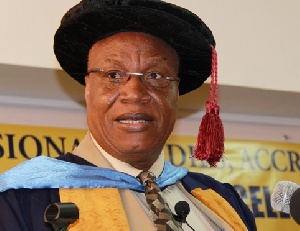

Chartered Institute of Bankers honours Prof. Alabi

The Chartered Institute of Bankers – Ghana, the professional body for banks and financial institutions in the country, on Friday honoured Professor Joshua Alabi, the Vice Chancellor of the University of Professional Studies, Accra (UPSA).

The Award was to recognize Prof Alabi’s contributions towards transforming the former Institute of Professional Studies into a full-fledged University; and for his enormous excellent performance in the financial landscape.

Mr Clifford Duke Mettle, the President, Chartered Institute of Bankers - Ghana, presented the Award to the Vice Chancellor in Accra.

An elated Prof Alabi expressed his gratitude to the Institute for the honour done him.

He dedicated the Award to the UPSA Governing Board, the Management, staff and students; whose contributions and support had enabled him turn the fortunes of the University around.

He said the rapid infrastructural transformation being witnessed at the University was achieved through internally generated funds from the students, and the judicious use of the funds by management.

The Vice Chancellor noted that the University’s vision was to become the world class education provider in both academic and professional discipline, nationally entrenched, regionally recognized and globally relevant.

At the same function, the University formally launched its news Bachelor of Science Actuarial Science, with the objective of providing high quality education in actuarial science in order to prepare students for further professional studies and the field of work.

Its areas of innovative specialization are business economics and finance; finance; risk and insurance management; pensions administration; health and insurance administration.

Mr Mettle lauded Prof Alabi’s exceptional transformational leadership qualities in harnessing the creative talents and energies of the staff and students to transform UPSA into a world class University; which makes him a worthy recipient of the award.

Speaking on the role of Micro Finance Institutions (MFIs) to national development, Mr Mettle said microfinance encompassed the provision of financial services and the management of small amounts of money through a range of products and a system of intermediary functions targeted at low income clients.

He said research by the Chartered Institute of Bankers showed that, microfinance had emerged globally as a leading and effective strategy for poverty reduction with the potential for far-reaching impact in transforming the lives of poor people.

He said the traditional banking sector had provided very little, or no services to low-income people, creating a high demand for credit and savings services amongst the poor; which microfinance had come to fulfill.

Mr Mettle said microfinance had significant impact on cross-cutting issues, such as women's empowerment, reducing the spread of HIV/AIDS and environmental degradation, as well as improving social indicators such as education, housing and health.

He said micro-credit was a key strategy in building global financial systems to meet the needs of the poorest people.

“We must not lose sight of the fact that MFIs contribute greatly to gross domestic product, the curbing of rural urban migration and reduction of unemployment,” Mr Mettle said.

“In all, the potential economic benefits of sustainable microfinance in Ghana are compelling, and its potential effects on the development process cannot be understated; this calls for a holistic approach by all stakeholders,” he added.

Dr Charles Barnor, Head of Banking and Finance Department, UPSA, said the newly introduced programme would enable students to be both academically and professionally competent in the fields of insurance, banking and finance.

Mr Francis Acheampong, Register of the Ghana Insurance College, said the programme would beef up the collaboration between the two institutions in the training of professionals in the insurance industry.

Ms Evelyn Ampoful, Actuarial Manager, Social Security and National Insurance Trust, said the introduction of the programme would save the nation from exorbitant spending on training actuarialists abroad.