- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

Business News of Monday, 14 September 2015

Source: Reuters

BoG raises benchmark rate to 25 percent

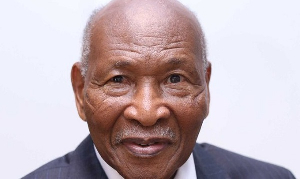

Dr Henry Kofi Wampah - BoG Governor

Dr Henry Kofi Wampah - BoG Governor

The Bank of Ghana on Monday unexpectedly raised its main policy rate by 100 basis points to 25 percent, the highest rate in over a decade, to offset the risk of inflation, its Governor Henry Kofi Wampah said.

The government says it is making strides to contain a fiscal crisis that drove the West African country to start a three-year aid program worth $918 million with the International Monetary Fund in April.

The budget deficit, which spiked in the election year of 2012, has fallen faster than expected, and the government expects medium-term growth to pick up.

But inflation stood at 17.3 percent in August, down from 17.9 percent in July, and Wampah said the Bank tightened its rate in order to reach the full-year target of 13.7 percent.

"It (the decision) is based on what we expect within the next few months or quarters," Wampah told a news conference. "We have noted that in the next quarter we are going to have a lot of liquidity .... That can have an inflationary impact."

Ghana is seeking a Eurobond of up to $1.5 billion on Sept. 22, and part of the proceeds will refinance debt, he said. The government is also due to sign a $1.8 billion loan on Thursday to finance its cocoa sector ahead of the 2015-2016 crop.

It is also expecting to raise utility prices, and all these factors could lead to a rise in inflation expectations, he said.

For years, Ghana's economy was one of the strongest in sub-Saharan Africa as the country benefited from high global prices for its exports of gold, oil and cocoa.

But a fall in commodity prices as well as fiscal problems that emerged after 2012 have led to a slowdown in gross domestic product growth, which is expected to stand at 3.5 percent this year, below the continent's average.

Other signs of the imbalances are a decline in the cedi currency that is around 50 percent since the start of 2014 and the debt-to-GDP ratio, which grew to 71 percent in June from 67 percent in May.

Wampah said the debt-to-GDP level is not "very dangerous" because the increase since May is mainly due to an exchange rate differential.

Razia Khan, head of Africa research for Standard Chartered, said the tightening demonstrated the seriousness with which authorities were taking the requirements of the IMF program.

"It should, therefore, be seen as a positive," she said. "It also highlights Ghana's ongoing vulnerability, with the cost of servicing domestic debt raised further in nominal terms .... The belief is that a successful Eurobond issuance will lessen dependence on domestic financing of the deficit."