- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

Business News of Tuesday, 7 July 2015

Source: B&FT

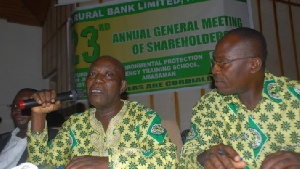

Loan defaulters ruining rural banks - Ga Rural Bank Chair

The board chairman of the Ga Rural Bank, Nana Bram Okaell, has expressed concern about the rising non-performing loans on the books of rural banks, which he noted has been aggravated by the involvement of some board-members of the banks.

He bemoaned the phenomenon whereby directors of rural banks contracts loans and refuse to pay up due to their position, which he reckons is gradually crippling the banks.

He told shareholders at the 23rd annual general meeting of the Ga Rural Bank in Accra that: “As long as I remain in charge, directors who take loans will have to provide collateral. Most directors refuse to pay up loans, and that has led to the collapse of some rural banks in the past”.

His comments were as a result of the removal of a board-member -- Samuel Oppong Mensah, who allegedly took credit from the bank to the tune of Gh¢38,000 and failed to pay up.

According to him, loans and advances to customers will have to be reviewed if the rural banks want to stay in competition.

“It is rather sad to note that our support to especially contractors and the transportation sector has not yielded the expected results. Most of the beneficiaries have not been faithful to us, and have let us down miserably. To this end we have reviewed our exposure to those areas.

“In 2014, the bank’s advances portfolio increased by 38% from Gh¢8,123,012 to Gh¢11,172,337, which is quite significant.”

His comments follow the bank’s grim performance last year, when it posted a marginal profit after tax of Gh¢433,858 for the year ended 31st December 2014, compared to Gh¢450,252 for 2013 -- a decrease of Gh¢16,394 representing 4 percent.

“The reduction in profitability was due to high operating costs and the need to prudently make higher provision for impairment losses on Advances and Depreciation. The economic conditions prevailing have made debt recovery very difficult and are threatening our credit portfolio.”

Despite the bank’s challenges last year, the board maintained their dividend per share of Gh¢0.07 (7Gp) and subsequently recommended an amount of Gh¢253,823 to be paid as dividend as against Gh¢168,223 declared in 2013.

The bank’s support to communities, institutions and projects in its catchment areas amounted to Gh¢34,500.

For the ensuing years, they intend to continue with their expansion drive by opening new branches at Ablekuma or Anyaa and Alhaji or Sowutuom. “Where necessary, we will reach our many unbanked or underbanked clientele through our microfinance and mobile operators.”