Cuts proposed by government to the massive fiscal deficit are not far-reaching enough and could lead to a credit-rating downgrade as debt escalates, analysts have warned.

Finance Minister Seth Terkper said on Tuesday that Government will narrow the budget gap - which widened to 12.1 percent of GDP in 2012 - to 9 percent this year and 8 percent in 2014. But analysts, including ratings agency Fitch, are unconvinced about the authorities’ committment to rein in borrowing.

“We had expected declines to 8 percent and 5 percent respectively. Therefore debt, which was 49.4 percent of GDP at end-2012, will remain high over the next two years,” Fitch said in a statement issued on Wednesday.

“The budget highlights how the impact of the fiscal blow-out ahead of December’s elections will persist for several years, as the authorities now appear to have moderate ambition and limited scope for a quick correction.”

Fitch lowered the outlook on Ghana’s B+ rating to negative from stable last month after the deficit came to light, and warned of deterioration in the country’s creditworthiness if Government fails to “set out and implement a credible fiscal consolidation plan”.

In 2007 Ghana relied on positive assessments by ratings agencies to sell its debut US$750million Eurobond. Standard & Poor’s and Fitch Ratings had rated Ghana B+ - with a stable and positive outlook respectively - ahead of that bond sale, which was oversubscribed by almost 400 percent.

Mr Terkper said Government will shift to longer-tenor bonds and loans, “preferably from the international capital market”, to meet capital-spending requirements and ease pressure on the short-end of the domestic Treasury market.

Government has hinted it is considering refinancing the Eurobond, which is set to mature in 2017 and is currently trading at a yield more than 3.5 percentage points below the initial coupon rate of 8.5 percent.

Investors who want to purchase bonds issued by a government often rely on its sovereign credit ratings to determine its ability to pay the debt. Ghana’s ratings, which include B1 with a stable outlook by Moody’s Investors Service, will be on investors’ radar as they await Government’s next steps on the maturing bond.

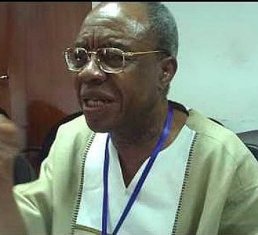

“We felt that Government could have sent a stronger signal about its efforts at fiscal consolidation,” said Dr. Joe Abbey, head of the Centre for Policy Analysis (CEPA). “We had thought that a deficit of 6.2 percent could have been targeted because it is doable.”

The deficit rose due to a sharp increase in spending on salaries, higher interest costs, and a binge on subsidies which was worsened by lower-than-expected revenues and grants, Mr. Terkper said.

Government will pursue complementary public-sector reforms to link wages - which swallowed more than 70 percent of tax receipts in 2012 - with productivity, he said. Wage spending is expected to rise by 12 percent this year, down from 47 percent in 2012.

“There are short-term bottlenecks to overcome, including management of the wage bill, power, sanitation and water problems. If we’re incurring the deficit to address these critical problems, then we’ll be able to explain better why we have set the 9 percent target,” said Dr. Abbey.

Mr Terkper struck an optimistic tone with his budget, attempting to assuage public frustration with the power crisis and the paucity of jobs. He announced initiatives to create new jobs in the agriculture, tourism and ICT sectors.

“Thus far, we have managed to push the economy onto a higher growth trajectory, maintained relative macroeconomic stability in the midst of turbulent global financial crises, and attracted sizeable investments into critical sectors of the economy,” he said.

"Government will work with the private sector to translate economic growth into the creation of jobs, especially for the youth."

Business News of Friday, 8 March 2013

Source: B&FT

Analysts fear for Ghana's economy

Entertainment