- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

General News of Wednesday, 23 January 2002

Source: Chronicle

US Giant Goes Burst 24 Hrs After Meeting With President

LESS THAN 24 hours after conferring with President J. A. Kufuor at the Castle, Kmart Corp, the third largest Supermarket in the US, yesterday filed Chapter 11 bankruptcy protection, the biggest retail bankruptcy ever, ending weeks of speculation about the financial health of this U.S. discount retailer.

The news came a day after Fleming Companies Inc., Kmart's biggest food distributor, halted shipments to Kmart after the retailer failed to make regular payments.

Fleming's move may have been the last straw for Kmart, which has struggled for months with sluggish sales and strong competition from No. 1 discounter

Ghana's Ambassador to the US, His Excellency Allan Kyeremanten, led the Vice President of Kmart, Mr. Apleby, who led a team to Accra to try and exploit the opportunities offered Ghana under the African Growth and Opportunities Act via the President's Special Initiative.

He was accompanied by Mr. Joe Ghartey of Ghartey & Ghartey, legal advisers on the PSI. But by the time they were visiting Accra, there was a mad pursuit by newsmen for Mr. Apleby as the president of the company had been removed as President.

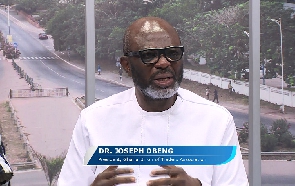

When Joe Ghartey was reached for his take on the implications for Ghana on the state of Kmart's trouble this is what he had to say

"We have not made any commitment to Kmart yet. Their visit is an exploratory one. And it is too early for people to make hasty conclusions because filing bankruptcy itself does not mean the end of ther company. It can be a strategic move at reorganisation and repackaging, and as far as the national interest goes, there has been no commitment and so people should be assured that we have not taken any precipitate action."

But Kaycee Intel (Kci), a local business investigations company, specializing in corporate due diligence, expressed concern and asked for due diligence in spite of the size of the Kmart name, Mr. Joe Abban, a research assistant of the company said yesterday.

In recent weeks, ratings agencies had downgraded Kmart's credit, its stock plunged and the company was removed from Standard & Poor's benchmark index of 500 leading stocks as their share prices had dipped dangerously towards the $1.00 mark, which immediately makes them candidates for de-listing.

The bankruptcy filing had been widely expected, but company officials had for several days declined to comment.

Kmart's bankruptcy filing, with $17 billion in assets, is the biggest ever for a retailer.

Montgomery Ward Holding Corp., which filed in July 1997, was third with $4.9 billion.

Kmart said it had secured $2 billion in debtor financing to pay its $1.6 billion in debt and expected to emerge from bankruptcy in about a year.

In Chapter 11 a company is protected from creditors while it reorganizes and tries to work out a plan to pay its debts.

"We are determined to complete our reorganization as quickly and smoothly as possible, while taking full advantage of this chance to make a fresh start and reposition Kmart for the future," CEO Charles Conaway said in a statement Kmart said all of its 2,114 stores were open for business and that all credit cards, gift certificates and store credits would be honoured as usual.

It also said its pension and savings plans are independent of the company and would be administered as usual.

"It's absolutely essential they [for protection]," said Kurt Barnard, president of Barnard's Retail Consulting Group.

"There's no question now. Vendors can now be assured they'll get paid for their merchandise." Martha Stewart Living Omnimedia Incorporated will be the next to pull out.

Martha Stewart representatives were unavailable for comment.

Kmart's debtor-in-possession financing gives it the critical liquidity needed to fund its operations during the reorganization process, a necessary first step in resuming our relationship," Fleming CEO Mark Hansen said.