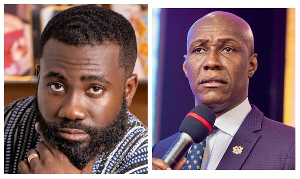

Prince Sarpong, Chief Executive Officer of ASN Financial Services -- a home financier, has described government as a ‘bystander’ as it is ‘not doing enough’ in the provision of affordable homes for Ghanaians.

He stated that when it comes to the provision of affordable homes for Ghanaians, what the government is doing currently is below standard.

“The government’s role in trying to provide homes for Ghanaians can best be compared to that of a bystander,” he said.

He believes that the major role government should be playing to fast-track the provision of affordable homes for Ghanaians is by providing credible guarantees for the private sector to enable them lead the race in providing affordable homes.

“We are not asking for sovereign bonds but just an off-taker agreement from government, whereby government can guarantee purchase of houses for its own workers. Teachers, police and immigration [officials] are all government workers who are facing accommodation challenges,” he said.

With a housing deficit of 1.7 million, the country needs to provide about 170,000 homes annually for the next 10 years in order to bridge that gap.

Across the country various affordable housing projects are ongoing, and in the past the Social Security and National Insurance Trust (SSNIT) has also helped to provide numerous homes.

Some of the projects underway currently include the Ghana-OAS Brazil 5,000 affordable housing project at Saglemi, Ningo; and GoG-Sethi Realty 5,000 affordable housing project at Kpone.

But with more than 80 percent of Ghanaians unable to afford homes or qualify for a mortgage, most real estate developers focus on the high end of the market -- putting a majority of the populace in a situation where they have to rent homes.

President John Dramani Mahama recently stated that through strategic partnerships with organised labour, financing institutions and real estate companies, the housing deficit can be bridged by utilising other available means like renting.

“We must seriously consider a mental shift toward a formal rental system. This could be the way forward to manage the inevitable consequences of rapid urbanisation. Rental housing will be affordable, cheaper for many and contribute faster to reducing the housing deficit,” he said.

He said many Ghanaians cannot own their homes, and the few who do and offer them for rent charge exorbitant prices. “Rental units are therefore in short supply. Unavailability of rental units for low- and middle-income earners means that rental conditions are expensive and difficult.

“Homeowners more often than not demand two or three years’ rent advance, a situation that further chokes the progress of clients,” he added.

He also said government has recently introduced a national housing policy with the overall goal of providing adequate, safe and decent affordable housing that is accessible and sustainable with infrastructural facilities, using the private sector as a driving force and government as a facilitator or partner.

Also, to tackle the issue of financing, a Housing Fund has been proposed to provide a steady stream of affordable funds for housing.

Mr. Sarpong, like any other private real estate player, hopes that the private sector engagement, which is crucial, will be put to the best of use so that Ghanaians can have quality homes.

He added that ASN Properties, the real estate subsidiary of ASN Financial Services, is working to change the real estate market landscape.

“What we are trying to do is to come to the end of the market and provide affordable housing schemes. We have come up strongly with a 10-year project to do a million houses at a very affordable rate with an affordable home finance scheme.”

He explained that the scheme will run through ASN Financial Services. “This means that if anybody wants to buy a home you need to buy it through ASN Financial Services, because ASN can provide home financing to them.

“We are not looking at those who are ready to give us 50 percent but rather looking at the end of the market, people who do not have the deposits needed for down-payment -- and these are people who have lower-income earning power or status,” he said.

With a product called the Home Investment Fund (HIF), clients can save in an investment-driven pool that will help investors own a home.

“All you have to do is pay 20 percent of deposit arranged in a year or two, three, four or five years. That is to say it gets you to plan having a home anytime you want.”

Available data indicate that Ghana is experiencing rapid urban growth, which has increased the demand for housing and put pressure on the government to provide sustainable human settlements.

From various assessments, Ghana’s population could reach 32.2million people in 2020, with about 57 percent living in urban communities.

Business News of Thursday, 23 July 2015

Source: B&FT