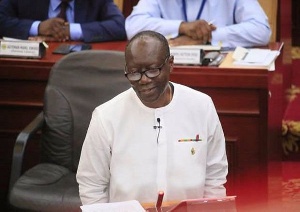

The Akufo-Addo government has promised tax incentives for Under-35 entrepreneurs as part of measures to “stimulate investment and to shape economic behaviour”, Finance Minister Ken Ofori-Atta told parliament on Wednesday, 15 November when he presented the 2018 budget.

Mr Ofori-Atta said the government will grant tax incentives and tax holidays to young entrepreneurs of age 35 years and below who start their own businesses based on the number of persons employed.

He also said the government will review the current income tax thresholds by pegging the tax-free threshold to the current minimum wage in an effort to protect low-income earners and ensure fairness in income tax administration.

Additionally, Mr Ofori-Atta said the government will introduce a Voluntary Disclosure Procedures (VDP) in the Revenue Administration Act, 2016 (Act 915) to waive penalty on voluntary disclosures and payment of unreported and understated taxes by taxpayers within a period agreed with the Commissioner-General of GRA.

He said the government will also extend the National Fiscal Stabilisation Levy (NFSL) and Special Import Levy (SIL) to end 2019: as a short-term measure as efforts are made to improve compliance.

Also, tax breaks will be offered to help position Ghana as a higher-education hub.

Business News of Wednesday, 15 November 2017

Source: classfmonline.com

Budget 2018: Tax holiday for under-35 entrepreneurs

Business