The Bank of Ghana kept policy tight on Wednesday in a bid to curb inflation, which surged to a new record of 16.9 percent in October.

The central bank’s Monetary Policy Committee (MPC) on Wednesday voted to increase its key lending rate by 200 basis point to 21 percent as concerns about inflation continue to mount.

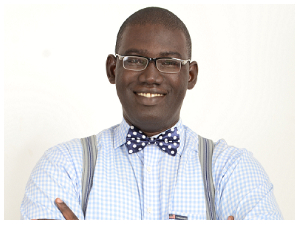

The policy rate was increased from 19 percent, while the interest-rate corridor was narrowed to 300 basis points from 500 basis points, Governor Kofi Wampah told a news conference in Accra on Wednesday after the 62nd MPC meeting

The rate at which the central bank lends to commercial banks remains unchanged at 24 percent, he said.

“The Committee decided to maintain the current tight policy stance and at the same time realign rates in the money market within the interest-rate corridor,” Dr. Wampah said.

Dr. Kofi Wampah said the central bank is concerned about the outward shift in the medium-term inflation path relative to the previous forecast.

“The latest forecast indicates that inflation will continue to remain outside the target band, but is expected to ease gradually toward the medium-term target band of 8.0±2 percent in the first half of 2016.

“The easing of inflation over the policy horizon is contingent on significant fiscal consolidation and maintenance of the tight monetary policy stance. In the absence of these, the inflation target could take a longer duration, in excess of 12 quarters, to be achieved considering vulnerabilities in the economy,” Dr. Wampah told journalists in Accra.

Consumer inflation rate increased for the 14th consecutive month to 16.9 percent in October 2014, from 16.5 percent the previous month.

The increase in policy rate and its associated interest-rate adjustments surprised the markets because it was a technical tweaking of policy that almost nobody anticipated. This is because the BoG increased the actual policy rate but maintained the rates at which it lends to and borrows from commercial banks.

In a quick response, Sampson Akligoh -- an economist and Managing Director of InvestCorp -- said the rate-hike comes as no surprise, except for the magnitude.

Explaining the MPC’s move, Mr. Akligoh said it is important that the central bank supports the current stability of the local currency at least within the short-term, which still activates a hawkish stance.

“It is an option to keep the exchange rate fairly stable at current levels for at least three months to rebuild some positive expectations. After the Eurobond and the syndicated cocoa loan inflows, policy-timing requires a focus on tightening until exchange and inflation rate dynamics are fairly anchored back at normal expectations,” he added.

Market analysts believe that the effect of the BoG’s action is interest rates in the economy will remain at their current high levels in order to help the central bank curb inflation. Although high interest rates are bad for economic growth, the central bank at the moment appears more concerned about inflation, which has in the last four months remained outside the BoG’s comfort zone.

Commenting on the impact of the MPC decision, Mr. Akligoh noted that: “Ideally, we should expect some rate-hikes for transaction interest rates based on recent inflation figures; but more broadly it is very unclear how the market will respond, especially in lieu of the more critical issues of the country’s engagement with the IMF and the impending 2015 budget which are more critical for forming expectations about the outlook for inflation and the domestic currency”.

Business News of Friday, 14 November 2014

Source: BFT

Policy rate increase aimed at tackling rising inflation - BoG