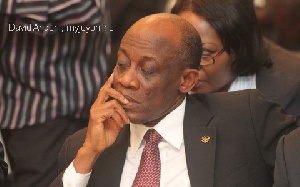

Mr Seth Terkper, Minister of Finance, has revised macroeconomic indicators for 2014 because of domestic and global difficulties that had impacted adversely on the economy.

“The developments in both the global and domestic economic environment have necessitated a revision of the macroeconomic framework and assumptions underlying the 2014 Budget,” he said.

Presenting the mid-year budget review to Parliament on Wednesday, Mr Terpker told the House that the current energy challenge, mounting inflation and interest rates coupled with exchange rate depreciation posed a strong downside risk to the achievement of the growth target.

He also cited the challenge involving decline in gold prices, challenges in the implementation of some of the revenue measures, slowdown in economic activity occasioned by the energy crisis.

He said government faced the challenge of implementation of the 10 per cent Cost of Living Allowance (COLA) to Government employees, implemented in May and slower-than-expected implementation of utility and petroleum price adjustments.

In line with the challenges, he said, the overall real Gross Domestic Product (GDP), including oil, growth has been rundown from 8.0 per cent to 7.1 per cent while non-oil real GDP growth is down from 7.4 per cent to 6.6 per cent.

The Minister also raised end of year inflation target of 9.5 per cent to 13.0 (+2 or-2 per cent) with the overall budget deficit target up to 8.8 per cent of GDP from 8.5 percent.

Gross International Reserves are pegged at not less than three months of import cover of goods and services.

The total non-oil tax revenue have been revised downwards by GH¢ 948.0 million to GH¢ 18,712.3 million, equivalent to 16.3 percent of GDP.

He added that the revised non-oil tax revenue for the year represents an increase of 38.1 per cent over the out turn for 2013.

The oil revenue have also been revised upwards by GH¢ 707.1 million to GH¢ 2,416.5 million and grants have been revised upwards from GH¢1,130.7 million to GH¢1,390.8 million.

Revenue and grants for the fiscal year have been revised upwards from GH¢ 26,056.5 million to GH¢26,230.3 million, equivalent to 22.9 per cent of GDP.

The revised revenue and grants for the year represents an increase of 34.7 per cent over the outturn for 2013.

The minister also told legislators that the estimate for total expenditure and arrears clearance have gone up by GH¢ 1,331.1 million from GH¢ 35,027.3 million to GH¢ 36,358.3 million (31.7 per cent of GDP) mainly on account of higher wages and salaries, interest payments, foreign-financed capital expenditures and subsidies.

He said wages and salaries have been raised from GH¢ 8,967.8 million to GH¢ 9,218.9 million due the COLA approved for public sector employees.

Mr Terpker also informed parliament that interest payments have increased from GH¢ 6,178.6 million to GH¢ 7,884.7 million while foreign-financed capital expenditure pushed up from GH¢ 4,525.8 million to GH¢ 4,748.7 million.

Provision made for subsidies in the 2014 budget have been jumped to from GH¢50.0 million to GH¢618.8 million.

Estimates for VAT revenue and total tax revenue, transfers to the National Health Insurance Fund, the Ghana Education Trust Fund and the District Assemblies Common Fund are estimated to be lowering than earlier projected.

But transfers to GNPC from the oil revenue have been surged from GH¢423.7 million to GH¢ 599.0 million.

However, interest payments and subsidies, estimated spending on goods and services have been slashed from GH¢ 1,550.0 million to GH¢ 1,085.0 million and domestic financed capital expenditure have been revised downwards from GH¢ 1,491.5 million to GH¢ 1,241.5 million.

According to him, given the revised revenues and expenditures estimates, the revised 2014 budget will result in an overall budget deficit of GH¢ 10,128.1 million, equivalent to 8.8 per cent of GDP, against the earlier estimate of GH¢ 8,970.8 million, equivalent to 8.5 percent of GDP.

Mr Terpker the new budget deficit will be financed from domestic and foreign sources supported by excess amount from the stabilisation fund for debt repayment, adding that foreign financing of the deficit is projected at GH¢ 5,936.3 million whilst domestic financing of the Budget is estimated at GH¢ 3,856.4 million.

An amount of GH¢385 million from the Stabilisation Fund would also be used to repay debt.

The aim of the Supplementary Estimate is to seek Parliamentary approval to commit additional resources to fund additional expenditures resulting from the revisions made to the 2014 budget.

He said: “We are requesting approval for a total amount of GH¢ 3,196,855,671 as Supplementary Expenditures.”

Business News of Thursday, 17 July 2014

Source: GNA