Scangroup has formed two advertising firms in Ghana and acquired the business of partner agency to boost its regional presence and reduce reliance on the East African market.

The firm will establish Scanad Ghana Limited and Ogilvy Ghana Limited that will take over the exiting advertising business of Media Majique and Research System (MMRS), which will stop operations.

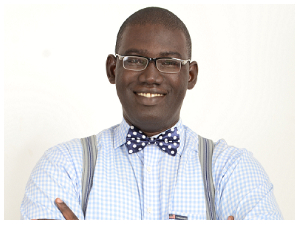

Scangroup will offer Mr Reginald Laryea $525,000 (Sh52.5 million) —who owned MMRS — and a 20 per cent stake in the twin firms to compensate him for transferring his lucrative clients including Airtel and Vodafone to the Kenyan firm.

“The entry into Ghana increases our footprint and marks another milestone towards our vision of becoming a leading marketing services company in sub-Saharan Africa,” said Mr Bharat Thakrar, the CEO of Scangroup.

“This will also enable us to service our pan-African clients better with in-market infrastructure”.

Besides giving the Kenyan firm a direct interest in one of Africa’s fastest growing economy, it gives it a larger foothold of the West African market it has been angling to get over the past five years.

Ghana’s economy may expand by 20 per cent this year as the start of oil production for export, along with high prices for cocoa and gold, boost revenue, according to the World Bank.

Scangroup intended to take a stab at the West African market in 2007 through Nigeria as it sought to get a slice of the market estimated at about Sh500 billion. But the deal, in partnership with a local investor, collapsed.

The Nairobi Stock Exchange (NSE) listed firm has in the past four years completed multi-million acquisition deals across East Africa as it sought to gain access to high spending clients without having to battle for them with rival firms.

“We buy firms to support future growth and gain access to critical clients,” says Mr Thakrar.

Last year, it bought a 50 per cent stake in Ogilvy East Africa and a 51 per cent stake in Ogilvy Africa in cash and stock transactions worth Sh418 million. The deal will give Scangroup minority stakes in eight media agencies in South and West Africa where Ogilvy Africa has stakes of between 30 per cent and 12.5 per cent — earning the Kenyan firm stakes of between 6.4 and 15.3 per cent.

In buying Ogilvy Africa, Scangroup will tap a long list of multinational firms including beer giant SABMiller, Unilever and BAT. Others are MultiChoice, Zain and Sun International, which promise to rev up its profits given the huge media spend of these firms.

In Kenya, the firm will gain access to equally high net worth clients such as Barclays Bank, Kenya Airways, India’s Bharti Airtel, and Telkom Kenya.

The buyouts have helped it tighten grip on the telecoms sector, especially the mobile telephony market, which have emerged as big media spenders.

In 2007, the firm acquired part of Redsky Uganda, in a move that gives it a piece of telecommunications business after it added Uganda Telecom to its client list.

It also acquired Redsky Kenya, which handles the Safaricom advertising budget that is said to be the biggest across East Africa.

In 2006, it acquired a majority stake in FCB Tanzania, the agency that handles Vodacom Tanzania and the biggest media spender in Tanzania.

It’s not about to put brakes on the acquisition drive as it looks to boost stakes in the companies it has minority interest through the Ogilvy buyout.

“We now hold minority interests in these firms and our intention is to enhance our stakes,” Mr Thakrar, told the Business Daily.

The targeted firms are based in Nigeria, Senegal, Cameroon, Gabon and Ivory Coast. Others are in Zimbabwe, Namibia and Burkina Faso.

The interest in these countries will help Scangroup to achieve its long held ambition to diversify its regional presence and reduce its reliance on East Africa. Mr Thakrar said the new buyouts will be financed through cash and stock transactions as the firm still has millions of un-issued shares.

The firm’s share price stood at Sh35.75 yesterday having shed more than 30 per cent in the past three months, but high media spend has seen its net profit rise 87 per cent to Sh374 million in the six months to June.

Business News of Thursday, 29 September 2011

Source: businessdailyafrica.com