THE National Health Insurance Scheme is expected to be launched by the end of the year to replace the cash-and-carry system, Health Minister Dr Richard Anane has announced.

To this end, the proposed scheme, which aims at providing affordable and acceptable health coverage for citizens of the country, is to be placed before Cabinet within the next two weeks for approval.

The cash-and-carry system was introduced in 1985.

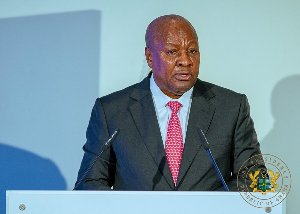

Dr Anane announced this when he unveiled details of the proposed National Health Insurance Scheme at a news briefing at Nkoranza in the Brong Ahafo Region on Tuesday.

During the year 2000 Presidential and Parliamentary election campaign, the ruling New Patriotic Party (NPP), then in opposition made a commitment that it would abolish the cash-and-carry system when the party was voted into power.

He said the Ministry of Health (MOH) decided to organise the programme at Nkoranza because of the area’s success story in the community health insurance scheme. The minister said the scheme would not be implemented to undermine efforts by other groups to run other schemes.

Dr Anane said the scheme would provide the means to pay for the care of the sick and for those who have the means to subsidise those who cannot pay.

He said it has been estimated that about ?80 billion would be needed a month to operate the scheme.

On how the scheme would be financed, Dr Anane disclosed that it has been proposed that the scheme would start with the establishment of a social health insurance scheme for about 850,000 people in the formal sector, who are already contributors to the Social Security and National Insurance Trust (SSNIT), and their dependants.

According to him, it has been proposed that employer-employee contributions to SSNIT move up from five per cent and 12 per cent to seven per cent and 18 per cent respectively, out of which 60 per cent of the amount realised would be retained by SSNIT and 40 per cent transferred to the national health insurance company that would be set up to administer the scheme.

The minister stated that it is proposed that the premium from the SSNIT contributions could cover five members of a family or a couple and three dependants.

Dr Anane said it has been proposed that five per cent of the annual gross profit of all alcohol and tobacco producing companies, 10 per cent of annual gross profit from SSNIT, 10 per cent annual gross investment profit from Ghana Reinsurance Company, among other sources, would be used to finance the scheme.

He said massive educational programmes would be organised to ensure successful informal sector contributions.

Dr Anane said although the proposed scheme is going to be discussed at Cabinet level, every Ghanaian must feel free to contribute to the discussions so that a better scheme would be evolved for the benefit of all the people.

General News of Friday, 17 August 2001

Source: From Kwame Asare Boadu, Nkoranza

Health Insurance To Replace Cash-and-Carry

Entertainment