Shama Cooperative Credit Union (SHACCU) recorded remarkable growth during the year under review.

It recorded a net surplus of GH¢246,467.18 during the financial year as against GH¢150,777.37 in 2014 representing 63%.

Savings in 2004 amounted to GH¢621,757 -- this figure increased to GH¢1,033,616 in 2015, representing an increase of 66%.

Also, loan to members also increased from GH¢2,450,221 in 2014 to GH¢4,120,409 in 2015 representing 68%.

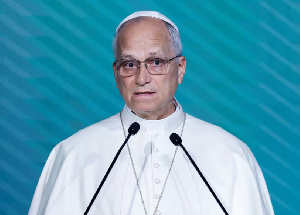

Mr. Joseph Anokwafo Arthur, Board Chairman of SHACCU, said these at the 10th Anniversary and Annual General Meeting of SHACCU at Shama in the Western Region.

“Your credit union recorded a loan delinquency rate of 1.4%, and this delinquency is one of the lowest in the country.”

He appealed to members who have not purchased their minimum shares to do so -- it is by purchasing the minimum shares that one can enjoy the benefit of being a member of the credit union.

Additionally, he said members should buy more shares so they can receive dividends at the end of the financial year -- this will increase the union’s capital base and enhance financial activities.

According to him, SHACCU continues to grow in strength year on year: “We will continue to improve our services to make them even more friendly”.

He said the credit union will be introducing Automated Teller Machine to give members easy access to their money while encouraging members to save on regular basis.

Business News of Sunday, 27 December 2015

Source: B&FT