An Export and Import (EXIM) Bank bill which is currently before Parliament has received attention with the document going through a second reading.

The bill is to provide legislation to back a project that will see Ghana provide some financial assistance to its local firms engaged in the business of export and import.

Ghana is pushing for a law that would help for the establishment of an Export and Import Bank aimed at transforming the local economy into a strategic position as an export-led economy.

When approved, the proposed EXIM Bank would operate like similar institutions in other countries.

The Ghana EXIM Bank is aimed at promoting the nation’s drive towards achieving a more diversified economy that would be able to resist external shocks alongside an improved capacity to produce goods and services in a competitive global market place.

The Bank would operate as a quasi-government institution and act as an intermediary between the government and exporters to issue export financing.

It would also operate as a non-deposit bank and assist exporters to compete internationally by providing insurance and finance facilities to support their overseas activities.

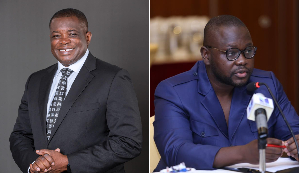

Mr Cassiel Ato Forson, Deputy Finance Minister, moved the motion for the second reading of the Bill.

Mr James Klutse Avedzi, the Chairman of the Finance Committee of Parliament, who seconded the motion, told Members that historically, Ghana has made efforts through a number of initiatives that are reflected in institutions and structures to support the export sector of the economy.

These institutions and programmes, he said, include trade promotion and export finance or guarantee institutions, EXIM Guarantee Company limited and export development and agricultural fund.

The second reading, however, generated a lively debate in Parliament with most members kicking against plans to make the proposed bank independent of the Bank of Ghana (BoG), and rather to be superintended by the Minister of Finance.

The MPs for Tamale South, Manhyia South, Tema East and Wenchi, Mr Haruna Iddrisu, Dr Matthew Opoku-Prempeh, Mr Daniel Nii Kwartei Titus-Glover and Prof George Gyan-Baffuor, respectively, among many others, argued that according to the country's laws, all banks were subject to the regulations of the BoG.

But the legislators contended that empowering the Minister to superintendent over the Bank would create an institution parallel to the BoG which might cause some conflict.

But the MPs for Old Tafo and Bawku Central, Dr Anthony Akoto Osei and Mr Mahama Ayariga, respectively, countered those arguments, saying the EXIM Bank was a special kind of bank and different from the traditional banks in the country, for which reason if the laws establishing it were different it would not be out of place.

Dr Akoto Osei, who made reference to the United States, Chinese, Indian and other EXIM banks, said none of them was regulated by the central banks of the countries within which they were established.

He said EXIM banks were different from other banks and that they were established with the sole purpose of ensuring an increase in a country's exports.

That distinction, he argued, needed to be made clear, adding that "maybe Parliament should be the body to regulate it".

Although there is an impressive development in the export sector, the perceived idea of transforming Ghana's economy into an export-led one has made it necessary to adopt a policy to drive this laudable idea.

The Government, consequently in the 2015 budget statement, announced its intention to establish an EXIM Bank to lead in the strategic positioning of Ghana as an export-led economy.

The proposed bank is envisaged to promote the acceleration of Ghana's drive towards achieving a more diversified economy to make it resilient to external shocks, alongside an improved capacity to produce goods and services in the competitive global marketplace.

The bill, therefore, seeks to establish an EXIM Bank which is a quasi-governmental institution that will act as an intermediary between national governments and exporters to issue export financing.

Politics of Thursday, 18 February 2016

Source: GNA