An SME Financing Fair is scheduled to be held on the 16 and 17 of March this year to help address access to financial challenges facing Small and Medium Enterprises (SMEs).

President John Dramani Mahama is expected to open the fair and exhibition which would also feature various fora with the aim of bringing representatives of the various stakeholders to discuss crucial issues on SME financing spaces.

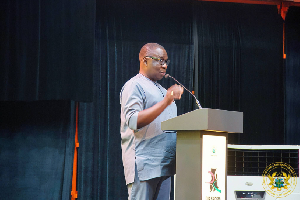

Mr Rashid Pelpou, Minister of State in charge of Private Sector Development and PPP, who launched the fair on Tuesday, said the government decided to initiate the fair to help create the enabling environment for SMEs to grow.

He announced that SMEs were major pillars of the Ghanaian economy, constituting over 90 per cent of businesses registered in Ghana.

He said the Ministry of Trade and Industry had also estimated that SMEs comprised over 160,000 registered liability companies and over 350,000 registered sole enterprises, generating over 40 per of GDP.

He explained that one of the key indicators of a flourishing economy was a vigorous Small and Medium Enterprises sub-economy and how they contributed to GDP.

Mr Pelpou said in Ghana, the bulk of SMEs are within the services sector, particularly hotels, restaurants, transport and storage, business and real estate, adding that the contribution of the service sector to GDP has been increasing consistently over the past four years.

“From a percentage of 48.4 per cent in 2012, the figure rose to 51.9 per cent in 2014 and 54.1 per cent in 2015. Obviously this sector alone has the potential to contribute to national prosperity and is one of the key employment-generating sectors in Ghana,” the Minister said.

He, however, said despite the important role that SMEs played in the national economy, the sector is faced with many challenges, particularly access to finance, which has been identified as a critical constraint on the ability to break out and unleash the full potential of SMEs.

“Recognising that the prevailing high interest rates and limited access to funding are debilitating forces against the SME sector, we are launching the SME Financing Fair in the bid to find lasting solutions to the challenges and to bring exposure to innovative financing mechanisms prevailing in the country now,” Mr Pelpou said.

He said the Fair would seek to reduce the cost of information asymmetry and its attendant effects by bringing the Banks, Non-Bank Financial Institutions (NBFI), government agencies and multilateral agencies and SMEs together in order to bridge the financial intermediation gap.

The abilities and capacities of SMEs in doing businesses would also be built in a more sustainable way while efforts and discussions on the way to make the financial sector more efficient and relevant to the needs of the private sector would be held.

“This will be achieved by improving the quality of financial intermediation to overcome the market failures that undermine the ability of innovative firms to access credit, promote financial innovation and increasing long term credit,” the Minister added.

He announced that an EXIM Bank Guarantee would be established to stand in as a surety for viable SMEs, which source for a bank loan instead of SMEs using their private properties as collateral.

Mr Muntala Mohammed, the Deputy Minister of Trade and Industry, said since SMEs provided employment for most Ghanaians, it was critical that “we look at alternative ways of improving their lots so they can continue to partner government to provide jobs for the unemployed youth”.

It is expected that the Fair would provide an avenue to make known to SME Entrepreneurs and various government and private sector initiatives, institutions and funding and financing solutions that could be taken advantage of, as well as bring to light, major issues to be dealt with in the quality of financial intermediation to increase credit to SMEs.

A pre-event engagement with stakeholders to seek their support and commitments towards the organisation of the fair and exhibition would be held at the Flagstaff House on February 2.

Business News of Thursday, 21 January 2016

Source: GNA

Ghana to host SME Fair in March

Rashid Pelpuo, Minister of State at the presidency

Rashid Pelpuo, Minister of State at the presidency