Businesses in the economy’s energy sector could face tougher times in accessing loans from banks, as the Bank of Ghana has backed banks in reducing their exposure to the sector amid concerns that many businesses in the country are earning too little to service their debts.

This is a consequence of the deterioration of quality for loans in the banking sector, which has forced banks to cut credit lines to businesses in a bid to control the speed of loan defaults -- which are feared could continue rising to unprecedented levels.

According to the latest financial stability report of the Bank of Ghana released last week, Ghanaian companies are seeing their cash flows suffer and are finding it tough to repay their debts…causing non-performing loans to rise rapidly.

It noted that loan defaults are currently the key risk banks face, as the quantum of non-performing loans in the banking sector has increased by about 60 percent to GH?4.9billion at the end of the first three months of this year -- affecting the profitability position of banks whose net interest income registered a growth of 14.8 percent in March 2016 compared with 37.3 percent growth registered for March 2015.

“Banks therefore have to step-up loan recovery efforts and tighten credit risk management practices in order to minimise losses from non-performing loans. In addition, ongoing efforts to reduce the banking sector’s exposure to the energy sector will further improve the industry’s asset quality,” the central bank noted in its latest report on the banking sector.

The central bank observed that between a period of 12 months from March last year, the ratio of non-performing loans has risen from 11.4 percent to 16.2 percent - the highest in six years - largely because of the economy’s slowdown amid high cost of doing business due to high utility tariffs and taxes.

More so, the banking sector’s capital-at-risk (NPL net of provision to capital) - according to the report - in one year worsened from 12.5 percent to 15.8 percent at end-March 2016.

As a result, banks have slowed down on loans and advances -- especially to the private sector which accounted for about 94 percent of the total credit, and declined by about 5.8 percent in March this year.

According to the Bank of Ghana, the hold-up in credit could restrain the accumulation of non-performing loans, which will further be enhanced by reducing the banking sector’s exposure to the energy sector.

This is in spite of the fact that businesses engaged in commerce and finance are more likely to default on loans than those engaged in the electricity, water and gas sectors.

This is informed by the fact that businesses in the commerce and finance sector accounted for the largest amount of the banking sector’s non-performing loans, followed by those in the services, agriculture, forestry and fishing sectors.

The three sectors accounted for 72.6 percent of non-performing loans as at the end of the first three months of this year, which indicates a worsening default situation in the three sectors as they accounted for about 54 percent of non-performing loans at the end of March last year.

Meanwhile, the electricity, water and gas sectors recorded the lowest non-performing loan ratios during the review period.

Nonetheless, support from the central bank for banks to be wary of the energy sector is in sync with sentiments of banking sector managers who believe the sector is too exposed to businesses in the energy sector, particularly the Bulk Oil Distribution Companies (BDCs).

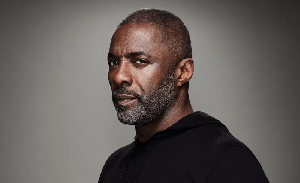

The Managing Director of Cal Bank, Frank Adu Jnr. in March this year told the B&FT that banks will continue to face difficult times for at least the next couple of years as a result of their exposure to the BDCs.

“The BDCs have a challenge in that they owe the banks so much money, and now the banks are no longer doing Letters of Credits to the BDC sector. That is obviously a big chunk of revenue wiped out.

“A lot of banks play in that sector, which is why non-performing loans have gone up across the board and it is not going to be easy recovering these NPLs -- because those companies that defaulted have to recover their business to pay the banks,” he said in an interview with the B&FT.

It is understood that between 2014 and 2015 Letters of Credit from the banking sector to the BDCs - and to some extent the Volta River Authority (VRA) - were valued at about US$3billion, and failure to retire the debts is said to be threatening the banking sector.

Business News of Monday, 27 June 2016

Source: B&FT