The Dangote Group, Africa’s leading indigenous conglomerate, has become the latest entity to join the African Export-Import Bank (Afreximbank) as a shareholder.

Information released by Afreximbank showed that the Dangote Group completed the process of acquiring equity in the Bank on 30 May 2016 with a “substantial investment”.

“I consider Afreximbank a good vehicle for fostering regional integration in Africa which aligns with our vision and mission for growth and development across the continent,” said Dangote Group President/CEO Aliko Dangote.

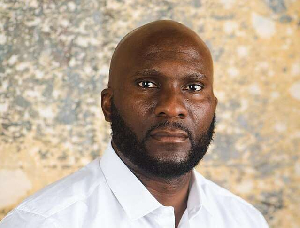

Welcoming the action by the Dangote Group, Dr. Benedict Oramah, President of Afreximbank, said that the investment was “a strong vote of confidence in the Bank by, arguably, the largest indigenous corporate in Africa”.

“The massive investments the Group is making across Africa makes it a partner of choice in the delivery of our Intra African Trade Strategy,” continued the President. “Working with the Dangote Group, we will build supply chain financing across Africa that could reach $1 billion in the short term, promoting intra-regional trade and growth of SMEs and creating much needed jobs.”

Afreximbank has four classes of shareholders, divided into classes A, B, C and D, which are made up of a mix of African governments, central banks, regional and sub-regional institutions, African private investors, African and non-African financial institutions, export credit agencies and non-African private investors.

Class “A” shareholders are African states, African central banks and African public institutions, including the African Development Bank, while Class “B” is made up of African financial institutions and African private investors.

Class “C” shares are held by non-African investors, mostly international banks and export credit agencies, including Standard Chartered Bank, HSBC, Citibank, China Exim Bank and Exim India. Class “D” shares, a tier approved in December 2012, are fully paid par value shares that can be held by any investor.

About Afreximbank

The African Export-Import Bank (Afreximbank) is the foremost Pan-African multilateral financial institution devoted to financing and promoting intra- and extra-African trade. The Bank was established in October 1993 by African governments, African private and institutional investors, and non-African investors.

Its two basic constitutive documents are the Establishment Agreement, which gives it the status of an international organization, and the Charter, which governs its corporate structure and operations.

Since 1994, it has approved more than $41 billion in credit facilities for African businesses, including about $6.2 billion in 2015. Afreximbank had total assets of $9.4 billion as at 30 April 2016 and is rated BBB- (Fitch) and Baa2 (Moody’s). The Bank is headquartered in Cairo.

About Dangote Group

The Dangote Group is an emerging African conglomerate based in Nigeria, West Africa, driven by a mission to touch the lives of people by providing their basic needs.

Current interests of the Group, which started as a trading company in 1978, include cement, sugar, salt, pasta, beverages and real estate, with new projects underway in the oil and gas sector.

Some of the Group’s 13 subsidiaries are listed on the Nigerian Stock Exchange. They include: cement, sugar, salt and flour. The Group operates in 17 other African countries and is fully involved in corporate social responsibility activities, which it executes through the Dangote Foundation.

Business News of Thursday, 9 June 2016

Source: classfmonline.com