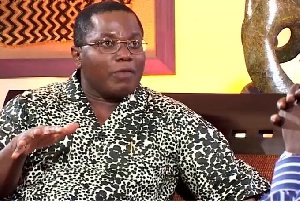

Renowned Economist, Dr Nii Moi Thompson has identified holes in the lecture delivered by Vice President of the Republic, Dr. Mahamudu Bawumia at the Economic Management Team Town Hall Meeting Wednesday.

Analysis by Dr. Nii Moi Thompson suggests the Vice President’s delivery was full of misrepresentations of the true state of the economy.

According to the economist, Dr. Bawumia misled the public with distorted facts as presented on both his graphs and the speech in general.

Dr. Nii Thompson in an article observed: “According to the veep, the cedi went into a tail-spin early in the year because the IMF told us to “increase our net international reserves” and that somehow “tied our hands behind our backs” as investors dumped cedis, bought up dollars and shipped it to their countries. How does a request to “increase your reserves” translate into tying your hands behind your back? It seems, on the strength of publicly available facts, that the veep was being economical with the truth.”

The article also exposed how the Vice President misrepresented figures on the graph to deceive the public.

“…In Graph 16, what he calls “YEARLY DEPRECIATION” and uses to boast that “the worst performance from 2017 to 2018 is better than the best performance from 2012 to 2016” is actually December-to-December depreciation (or what the BoG, his evident source, calls “cumulative” depreciation), and not “yearly depreciation”.

What he claims was a 14.5% depreciation for 2013, therefore, should really have been 8.4%. And what he has as a 4.9% depreciation for 2017 is actually 9.9%, while the annual depreciation for 2018 was 5.2%, and not 8.4%. In short, the whole graph “make bassaa” – much like the rest of the speech. We deserve better next time,” the economist revealed.

Read the full article below

When one considers the fact that the precipitous fall of the cedi against the US dollar is what prompted Dr. Bawumia’s lecture-cum-town hall gabfest yesterday, then perhaps his single most important statement about the cedi was as revealing as it was obfuscating. (And I haven’t even touched on the many graphs he used that were flat out bogus, like the one purporting to show growth in industry that somehow “stacked” up to 25%. But, I digress..)

According to the veep, the cedi went into a tail-spin early in the year because the IMF told us to “increase our net international reserves” and that somehow “tied our hands behind our backs” as investors dumped cedis, bought up dollars and shipped it to their countries.

How does a request to “increase your reserves” translate into tying your hands behind your back? It seems, on the strength of publicly available facts, that the veep was being economical with the truth.

I’ll show that in a second, but first a quote from my article last year entitled, The Bible, the Budget, and Bob Marley:

“• In this distorted economic environment of artificially inflated consumption and steep cuts in critically needed infrastructure spending, the cedi could only survive by virtue of proceeds from Eurobonds, as suggested in the MPC’s May 2018 report:

“So far, the recently issued Eurobond raised the levels of international reserves to US$8.1 billion (4.4 months of import cover) as at 17th May 2018, providing enough cushion against any potential external vulnerability.”

• Once the Eurobond proceeds started dwindling, the cedi came under pressure, losing ground rapidly against the US dollar by mid-2018.”

Now, let’s go for the devil in the details.

According to the BoG’s Statistical Bulletin of December 2018, the gross reserves for all of May 2018 was actually US$7,835.13 million, which was good for 4.25 months of imports.

The reserves at Dec. 2017 had been US$7,554.84 million, which were also good for 4.25 months of imports. By April 2018, however, as the fundamentals of the economy weakened, the reserves had fallen to US$6,901.1 million, with the import cover falling to 3.77 months.

Following the temporary relief provided by the eurobonds in May, the reserves came under pressure again and by December 2018, they were down to US$7,024.78 million and could support only 3.62 months of imports, according to BoG.

The net reserves (the gross minus liabilities, a better measure, which the IMF focused on) followed the same trend: it peaked at US$4,649.71 million in May 2018, having fallen to US$3,871.41 million in April, down from US$4,522.48 million in December 2017.

Not surprisingly, the cedi also came under pressure as the reserves dwindled. In May 2018, it had depreciated by 3.1%, year-on-year, but by December 2018, that had more than doubled to 8.4%.

All the IMF did was to tell us to shore up our reserves before we moved from bad to worse. But foreign investors, ever vigilant about the true state of our finances, sensed the government’s inability to meet the IMF’s diktat and decided to bail out before the reserves ran out and left them with cedis they couldn’t convert.

By January 2019, the depreciation rate had risen to 10.4% year-on-year, and then to 20.4% in February. It took a US$3 billion eurobond, complete with a kenkey fiesta, to calm nerves, although by then the harm had been done – petroleum and other prices had already gone up and would not come back down.

I’m pointing all this out because when you buy into your own hype and ignore the fundamental causes of your problems, they tend to fester and consume you later.

I don’t want Ghana to be consumed!

Lastly, I’m happy to see that since I criticised him for misleading the public with depreciation rates that exceeded 100% (a physical impossibility because nothing loses 100% of its value and remains in existence), the vice president has kept to more traditional approaches of calculating percentage changes in the exchange rates.

But even that has some serious problems. A close look at Graph 16 of his lecture shows that he still has difficulties distinguishing between average annual depreciation and end-of-period (or December-to-December) depreciation. As I said in a previous article, the difference is not trivial and a failure to tell the two apart can lead to faulty conclusions and ineffective, possibly even harmful, policies.

In Graph 16, what he calls “YEARLY DEPRECIATION” and uses to boast that “the worst performance from 2017 to 2018 is better than the best performance from 2012 to 2016” is actually December-to-December depreciation (or what the BoG, his evident source, calls “cumulative” depreciation), and not “yearly depreciation”.

What he claims was a 14.5% depreciation for 2013, therefore, should really have been 8.4%.

And what he has as a 4.9% depreciation for 2017 is actually 9.9%, while the annual depreciation for 2018 was 5.2%, and not 8.4%.

In short, the whole graph “make bassaa” – much like the rest of the speech.

We deserve better next time.

Nii Moi Thompson

Accra. 4th. April 2019.

General News of Friday, 5 April 2019

Source: awakenewsonline.com

Bawumia’s graphs were 'bassaa' much like the rest of his speech - Nii Moi Thompson jabs

Business