By Ben Hirschler

LONDON, Nov 4 (Reuters) - Ghanaian gold mining company Ashanti Goldfields Go Ltd said on Thursday it still hoped to merge with Lonmin Plc, despite Lonmin's withdrawal of its bid.

British-based Lonmin, Africa's third biggest platinum producer, withdrew its improved offer worth $7 a share for the continent's third largest gold miner late on Wednesday after Ashanti said it was unable to accept.

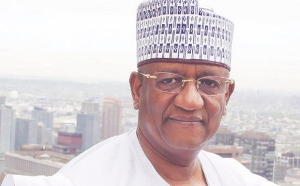

Ashanti Chief Executive Sam Jonah it had been a ``tactical withdrawal'' because the Ghana government, which has a 20 percent stake and a veto vote in the company, was not convinced of the merits of the deal.

``The merger was our idea and we are still committed to building a focused precious metals company,'' Jonah told Reuters after Ashanti announced a fall in third quarter profits.

``We see a lot of merit in the deal. We have a view of gold and we have a view of platinum and, frankly, we think platinum has a more assured future than gold.''

He said he hoped the government would come round to seeing the benefits of the merger idea, under which the new group would be named Ashanti Plc and keep its Accra stock market listing.

Mining analysts said Lonmin, which already owns 32 percent of Ashanti, had miscalculated by failing to win support from the Ghana government before launching its bid.

POLITICALLY SENSITIVE

The future of Ghana's biggest company and the possibility it will fall into foreign hands is a politically sensitive issue for President Jerry Rawlings.

But John Clemmow of Investec Henderson Crosthwaite said the struggling gold miner, reeling from massive gold hedging losses, remained a takeover target.

``Ashanti is in play. Lonmin is still in with a chance but I think others are too,'' he said. AngloGold Ltd of South Africa and Canada's Barrick Gold Corp are among major mining companies to have expressed interest.

Jonah declined to comment on the level of the Lonmin bid but said pricing would be one issue that would be revisited if talks resumed.

Ashanti announced an 82 percent increase in resources at its Geita gold mine in Tanzania to more than 12 million ounces, effectively increasing the value of its most promising asset.

Lonmin, whose shares fell five pence to 615p by 1030 GMT, said it remained open to the resumption of merger talks with Ashanti and the Ghana government. Ashanti shares were quoted three percent lower at $4.60 in London.

Jonah said rebuilding the balance sheet of Ashanti was now the immediate priority.

The company has appointed Chase Manhattan and Barclays Capital to advise it and ``all options'' are under consideration. Under the terms of a three-year reprieve on margin calls agreed this week with 15 banks, Ashanti needs to come up with a funding plan by December 2.

GEITA AND OBUASI NOT FOR SALE

``No option is closed...but selling assets is not the preferred solution,'' Jonah said, adding that the sale of either the Geita or the century-old Obuasi mine in Ghana was ``completely out of the question.''

Ashanti reported lower third quarter earnings of $18 million, before an exceptional charge of $10 million for labour rationalisation at the Obuasi mine. Earnings in the year ago period were $20.3 million, before an exceptional charge of $30 million for the Iduapriem mine.

Gold output in the three months to September 30 also fell to 379,543 ounces from 420,162 a year ago, reflecting exceptional rains in Ghana which disrupted production.

But Jonah said things had since improved. ``We can look forward to a much better fourth quarter,'' he said.

He added that Ashanti would be actively managing its gold hedge book but intended to retain the current overall level.

``We think it is still prudent to maintain the current level of hedge, which is about 40 percent of reserves. We don't intend to increase it -- we intend to manage it.''

Forward sales and put options contracts, designed to provide gold price protection, totalled a net 8.9 million ounces at an estimated average price of $374 per ounce as of November 1.

General News of Friday, 5 November 1999

Source: Reuters

Ashanti wants Lonmin deal despite problems

Entertainment