Tigo, in partnership with BIMA and Prudential Life, pays out 25,000 claims worth GHS 11 million in Ghana

Claims payout of GHS 11 million since Tigo partnered with BIMA and Prudential Life to offer insurance in 2010 1.6 million Ghanaians registered on Tigo Insurance policies and 1.8 million lives insured

Accra, 8 December 2017 – Tigo Insurance has paid out 25,000 claims worth GHS 11 million (US$2.4 million) to insured families in Ghana since its launch in 2010. The number and magnitude of the payouts indicates the increasing prevalence of insurance in Ghana and the vital role it plays in ensuring financial stability for families.

This marks a significant milestone for Tigo Insurance, which is managed by BIMA and underwritten by Prudential Life, and reaffirms its commitment to provide customers with financial protection.

To mark the 25,000 claims milestone, Tigo Insurance has also introduced a ‘No Claims bonus’ that will reward loyal customers who have not made claims with free airtime and data.

Former Tigo Ghana, now AirtelTigo partnered with BIMA, a leading micro insurance provider with operations in 14 countries, in 2010 to provide its subscribers with simple and affordable access to insurance products underwritten by Prudential Life, one of the top life insurers in Ghana and the world.

BIMA’s mobile insurance technology enables customers to sign up for products on their mobile phones where daily payments will be automatically deducted from their mobile credit.

The accessibility and affordability of Tigo Insurance products has played a key role in helping drive the insurance penetration rate in Ghana from 8% in 2010 to 29% in 2015. Since BIMA entered the market in Ghana in 2010, it has sold over 5 million policies and 1.6 million customers currently signed up on Tigo Insurance.

The financial and social impact of insurance is particularly far-reaching for the underprivileged and the unbaked who lack other sources of financial protection. 90% of Tigo Insurance customers live on less than GHS 1000 per month, and almost 60% of them do not have a bank account. For low-income families or people who work in the informal sector and therefore have no employment protection, funeral costs or hospitalisation could throw them into extreme poverty.

“When I lost the use of my leg, my inability to work put me in financial stress. The GHS 1,800 payout from Tigo Insurance allowed me to pay my hospital bills and cover my family needs during a difficult time” said Mr. George Manyo, one of Tigo Insurance’s customers.

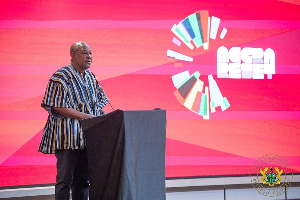

The 25,000 claims milestone was celebrated at AirtelTigo Head office in Accra on December 8, 2017, which was attended by the dignitaries from the National Insurance Commission, representatives from AirtelTigo, BIMA, as well as Prudential Life, along with former Tigo customers who have benefited from the claims payouts.

Russell Haresign, Country Manager of BIMA Ghana, commented, “The 25,000 claims demonstrate our commitment to help families get through challenging times. Proving to our customers that we are able to pay claims in a quick and efficient manner has been a key driver of Tigo Insurance’s success so far.

It is our promise to customers that all valid claims are paid within three days, and we are currently experimenting with WhatsApp to make the claims process even easier. With the introduction of the ‘No Claims Bonus’, we also want to show that loyal customers who fortunately didn’t have to claim are also being rewarded in the form of free airtime and data”.

Justice Yaw Ofori, Commissioner of the National Insurance Commission, congratulated Tigo, BIMA and Prudential Life on their work in making insurance more accessible: “Their work has fueled financial inclusion and contributed to the development of Ghana’s insurance sector. We are positive that insurance penetration will rise further still as more people recognize the value and benefits of insurance.”

“Insurance penetration in Africa is still extremely low, so it is particularly encouraging to see that Ghana is making such advancements. We are pleased with the tremendous impact that our work has had on the lives of so many Ghanaians in protecting families from life’s unforeseen circumstances. It has been a delight to partner with Tigo and BIMA and we look forward to bigger strides ahead,” commented Emmanuel Mokobi Aryee, CEO from Prudential Life Insurance Ghana.

About BIMA

BIMA uses mobile technology to deliver affordable insurance and health products to underserved consumers and families in emerging markets who cannot access these vital products through traditional channels.

BIMA’s technology platforms create a paperless experience and enable scale, while the agent force distributes products and provides customer education. This tech-enabled approach is the key to BIMA’s growth, reaching 24 million subscribers in 14 markets across Africa, Asia and Latin America. BIMA proves that it is possible to service the bottom of the pyramid profitability and sustainably.

BIMA works with mobile operators, banks and microfinance institutions as well as a growing range of corporates. All partners share BIMA’s mission to reach underserved consumers, with 93% of the global customer base living on less than $10 per day and 75% accessing insurance for the first time.

About Prudential

Prudential Life Insurance Ghana is one of the top five life insurance companies in Ghana. It employs approximately 100 staff and more than 1,000 agents and has over 1.8 million customers. Prudential is a wholly owned subsidiary of Prudential Plc UK one of the world’s leading financial services groups with £635 billion of assets under management as at 30th June 2017. Prudential plc has been in existence for 169 years and is listed on the stock exchanges in London, Hong Kong, Singapore and New York.

Business News of Tuesday, 12 December 2017

Source: Bima Ghana