- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

General News of Monday, 4 November 2013

Source: New Statesman

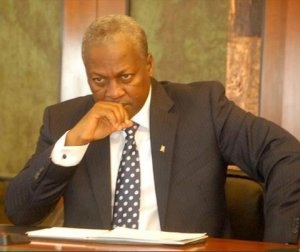

Fortiz reluctant to absorb Ghc57m loan to Mahama’s brother

New Statesman Investigations have revealed that the proposed sale of Merchant Bank to Fortiz is still clothed with the same conditionalities that surrounded the previous attempted sale of the bank to FirstRand of South Africa.

According to credible evidence gathered by the paper, Fortiz is not willing to accept non-performing assets, including the Ghc57 million loan given to Engineers and Planners, the company owned by Ibrahim Mahama, younger brother of President John Mahama.

It is recalled that FirstRand, the South African Bank that offered to purchase a 75% stake in Merchant Bank for Ghc91 million, also declined to accept the non-performing assets of the Bank.

Fortiz was one of the three companies shortlisted a couple of months back as likely candidates to take over the bank. And it is owned by a 3-man National Democratic Congress group, Fortiz “investors in the banking and real estate sectors.”

The 3-man NDC group is composed of Eliken Adadevoh, Kokui Ben Korley and Sam Adu. They are to acquire 90% stake in Merchant Bank for $36 million and pay majority shareholder of the Bank, SSNIT, and others Ghc12 million.

SSNIT, according to New Statesman investigations, injected Ghc42 million into Merchant Bank last year alone.

Fortiz, the paper has learnt, are proposing to invest Ghc100 million post acquisition when they have all the bank’s assets which can be collateralized.

Sources familiar with the deal say the bank which was put up for sale again in July this year after its acquisition deal with First Rand Bank of South Africa fell through, is likely to complete the sale transaction before next week begins.

It is recalled that the NPP in the run-up to the December 2012 elections, at a series of press conferences, stated that it was convinced that the predicament of the bank had been necessitated by poor corporate governance of the management and the possible official influence from President Mahama.

According to reports, in 2007, the Bank’s Managing Director, Blaise Menkwah, curiously approved a loan of over Ghc57million to Engineers and Planners, a company owned by Ibrahim Mahama, younger brother of President John Mahama, with no security.

The huge credit (19.2 per cent of Merchant Banks’ total liability) which was scheduled for maturity in three years (end of 2010) was not secured.

The loan was reportedly left un-serviced by E&P since the NDC assumed power in 2009.

The NPP at the time said it smelt a rat because in the transaction with FirstRand, the reconditions was for some loans in the books of Merchant bank to be ring-fenced by the shareholders. As part of the excluded loans on MBG’s balance sheet was the Ghc57 million extended to E&P.

“Top on the list of the companies whose debts have been forced down the throat of workers’ pension, owing 19.1% or Ghc57.2m, is Engineers & Planners Company Limited, a business owned by the junior brother of President John Dramani Mahama,” said the NPP’s then Deputy Communications Director, Yaw Buaben-Asamoah, in a statement released.

“When your company falls into bad debt and cannot service its loans and the pension fund of the workers of Ghana are forced by the President, who happens to be your brother, for that pension fund to ring fence and take on your debt, then we have to ask some serious questions,” the NPP said.