By Reynt-Jan Sloet van Oldruitenborgh

ACCRA, Dec 31 (Reuters) - Faith Investors, a group made up of local and U.S. interests, has bought a controlling 60 percent stake in Ghana's National Investment Bank Limited from the state, Faith and the national divestiture committee said.

It is paying $8.4 million for the stake.

Faith Investors, registered in Delaware in the U.S., is a consortium, comprising local company Faith Brothers and Lincoln Trust of the U.S. It has the backing of Riggs Bank of the United States.

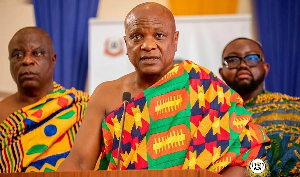

``It was important for Faith Brothers to be able to have a solid financial institution as a partner in order to do the kind of investment banking transactions that we think this market needs,'' Nana Asante Bediatuo, managing director of Faith Brothers, told Reuters.

He was known under the name Kofi Asante before he became a local chief in mid-December.

The National Investment Bank (NIB), established in 1963 as an autonomous development institution sponsored by the state and private interests, is an industrial development bank, which, in recent years, has taken up commercial banking as well.

It showed a profit of 4.35 billion cedis ($1.2 million) in 1998, down from 7.20 billion in 1997.

``NIB has some problems. It has an eroding deposit base. It lacks credit management and it is not performing well in terms of balance sheet management. It seems to have gone off entirely its investment banking and development finance role. And the numbers have just not been very good,'' Asante said.

The business plan presented by the purchasers shows they intend to expand the development banking side and develop personal and commercial banking.

After restructuring, perhaps in three or four years, the new owners would like to float the bank on the Ghana Stock Exchange.

``Our approach will be very aggressive. We intend to let the market know that there is somebody here in Ghana looking into providing development finance capital and venture capital,'' Asante said.

``There is a problem with affordable long-term capital in this country. We think that we can find innovative ways to close that gap.''

($ - 3,500 cedis)

General News of Saturday, 1 January 2000

Source: Reuters

U.S.-backed group buys NIB Investment Bank

Entertainment