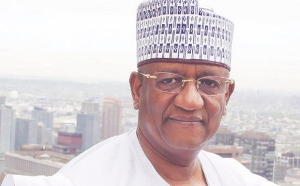

Finance Minister, Seth Terkper, is upbeat other ratings agencies like Fitch and Standards and Poors, will follow suit and give Ghana positive grades, after Moody’s, last Friday, upgraded the country’s sovereign rating to a B3, with Stable Outlook.

“We can enter 2017 on a more hopeful note unlike previous election years’ eras. The turnaround story is not going to be all about austerity…Hopefully the ratings will be telling a better story of government’s performance,” the Finance Minister told a press conference yesterday.

The rating agencies are following “the consolidation and the turnaround story of the economy,” the Finance Minister said. “I hope that Ghanaians would see that the sacrifice and dedication on the IMF programme and the homegrown policies have helped to show that if we continue on this path Ghana can put the idea of election years’ budget overruns behind it.”

Before it announced the latest ratings, Moody’s had since March last year rated Ghana B3, with negative outlook, on the back of shocks arising from external deficits and fears of spending outside the approved budget this election year.

The negative ratings stem back to the dismal economic performance registered in 2012, when the deficit reached double figures, among other less than impressive macroeconomic indicators.

The country is still rated by Standard & Poor’s and Fitch Ratings at B-/ Stable Outlook and B/ Negative Outlook, respectively.

Moody’s said that its latest stable outlook is predicated on the significant reduction in the country’s deficit, from above 10 percent in 2012 to 6.3 percent in 2015, achieved under the three-year Extended Credit Facility (ECF) programme with the IMF.

Moody’s latest review comes after government, earlier this month, successfully issued a 5-year-US$750 million Eurobond, priced 9.25 percent, despite concerns that the coupon rate on the bond was a bit on the high side.

“All three ratings agencies after 2012 had problems with the economy and downgraded us. What happened with the homegrown economic policies and the IMF programme was that the downgrade stopped, which is similar to the debt story,” Seth Terkper said.

“First, you halt the growth of debt; you make an effort to control the factors which are leading to the downgrade – that is, using the IMF programme and the home grown policies,” the Finance Minister explained.

Business News of Wednesday, 28 September 2016

Source: B&FT

Terkper soaks in Moody’s optimistic rating

Entertainment