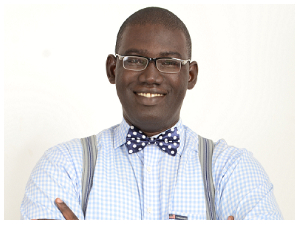

Imposing any form of tax on mobile money transactions will be a major drawback to the financial inclusion agenda championed by government, Akinwale Goodluck, Head of sub Saharan Africa at GSMA, the global body that represents the interest of mobile operators worldwide, has said.

“I am very concerned anytime there is any indication that government or anybody wants to take any step that may inhibit the growth of mobile money. When you tax mobile money, you are taxing the people who are probably the most excluded in mainstream financial service.

These are people who have found a financial niche in mobile money and taxing it will raise the cost of such a service. There is a strong likelihood that this will be a disincentive for people to use mobile money and it could reduce mobile money adoption and increase the divide in terms of financial inclusion,” he told the B&FT at the GSMA Mobile 360 Series West Africa which came off in Abidjan last week.

The idea of taxing mobile money transactions was suggested by the Communications Minister, Ursula Owusu Ekuful, during her vetting by the Parliament’s Appointments Committee in February 2017.

She told the Committee that it may not be a bad option as it will generate revenue for government; though she said government was yet to consider the decision.

Later in the year, the minority in Parliament cautioned the government about the introduction of a tax on mobile money.

Even though the government refuted the claims, industry watchers are wary that the issue is still on government’s mind as it seeks avenues to bridge the budget deficit of about 6.3percent of GDP.

Ghana’s mobile money space has seen consistent growth since it began almost a decade ago. In 2017, the total value of transactions stood at GH¢156billion–representing a 98.5 percent increase from the 2016 value of GH¢78.5billion.

With almost a billion transactions in volume, representing a 78.4 percent rise from 550 million in 2016, the total balance on float has increased by 84.6 percent from GH¢1.3billion in 2016 to GH¢2.3billion in 2017.

With mobile money transactions rising rapidly, government sees it as an easy platform to tax and collect revenue. But Mr. Goodluck sees it as “punitive” and “counterproductive” to the plan to deepen financial inclusion.

“Mobile money is an enabler. It helps financial and social inclusivity. It would be particularly burdensome for anybody to impose a tax on mobile money transactions. The ability of mobile money to impact lives and make a paradigm shift in the way we live in sub-Saharan Africa and in Ghana is unimaginable,” he said.

He instead urged government to take steps to increase the volume and value of mobile money transactions because increasing the depth of mobile money draws millions into the financial ecosystem which broadens the tax base for government.

He believes that government needs to look at the advantage of using mobile money instead of cash.

“Do the traditional means of banking have the same levels of penetration? No. This should be about encouraging the alternative channels, rather than punishing these channels.

Government should continue to look at the mobile system as an enabler and see how to develop the digital economy and use it to create jobs and opportunities. These are the things that should be the focus of attention for governments. Then we can create jobs and happiness for the people,” he said.

Business News of Tuesday, 17 April 2018

Source: thebftonline.com