The flagbearer of the opposition National Democratic Congress (NDC) has directly implicated President Nana Akufo-Addo and Vice-President Dr Mahamudu Bawumia in the recent seizure and auction of properties belonging to the Produce Buying Company Limited (PBC).

The Agricultural Development Bank (ADB) and five other banks, obtained a court order preventing the sale or transfer of PBC Limited’s assets, including its significant headquarters at Number 106 Olusegun Obasanjo Way, Dzorwulu Junction in Accra.

It’s not clear, how many workers have lost their jobs as a result of the development.

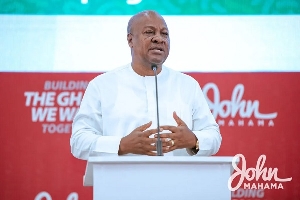

But in a Facebook post, Ex-President John Dramani Mahama shared a video showing a towing truck driving away a PBC pickup vehicle, accompanied by the caption, “Akufo-Addo and Bawumia’s day of shame! Banks tow away PBC’s assets for auction. From 30% market share in 2016 to 0% share in 2024.”

The seizure follows a judgment obtained by the six banks, which include, Cal Bank, Bank of Africa, GCB, Universal Merchant Bank, and United Bank of Africa, against PBC Limited.

The attachment order, granted by Chief Justice Gertrude Torkonoo, was the result of PBC Limited’s alleged failure to meet its debt obligations to the banks, even after a judgment was delivered in favour of the banks in October 2023.

The court order, prominently displayed at the PBC headquarters, prohibits any acquisition of an interest in the property. Ex-President Mahama’s social media post emphasizes the severity of the situation and places the blame squarely on the current government leadership for the auction and seizure of PBC assets.

The court order, issued by Chief Justice, Gertrude Torkonoo, highlights the gravity of the situation and is a response to PBC Limited’s alleged failure to fulfil its debt obligations to the plaintiffs.

The developments signal a significant downturn for PBC, from holding a 30% market share in 2016 to a reported 0% share in 2024.

Ahead of the auctions, the Public Affairs Manager of COCOBOD, Fiifi Boafo, said sometime in April last year, that COCOBOD had no intention to watch PBC, an indigenous cocoa-buying company, collapse.

According to him, despite the significant challenges facing the company, the COCOBOD has initiated several measures to ensure that the company is reinvigorated and stays afloat.

Speaking on JoyNews’ PM Express, he said, “I agree that there is a challenge there, but when a business is in a critical situation, it is not when you say that the fact that you have a challenge so automatically that business must collapse. There are private businesses that are going through challenging moments but they’re looking at means of ensuring that they’re able to stay afloat.”

JoyNews’ investigations have revealed how the country’s biggest indigenous cocoa-buying company, PBC, risks a possible collapse, following its steep decline in market share from 30.88 percent to 8 percent over the last five years.

In January last year, the management of the company hinted at downsizing its staff because it was unable to meet financial and operational obligations to its workers.

In August 2022, management issued a memo saying it was unable to pay salaries to staff. It’s now a tale of huge debts, fallen revenue, tonnes of cocoa beans stuck in the farms, and produce clerks engaged in double trading to survive.

According to Fiifi Boafo to reverse the misfortune of the company, the COCOBOD is taking rapid steps to ensure the survival of the company.

He said, “COCOBOD is ensuring that PBC is able to get seed funds. COCOBOD provides them with seed funds such that they’ll be able to go to the market and buy cocoa….we have a special arrangement, a special dispensation has been created between the Ministry of Finance and SIGA where we give them the seed fund without them providing a guarantee. If they’re not providing a guarantee, it means that they’re able to save some money because raising that guarantee from the bank will come at a cost. So that cost is also taken off of your cost of running your business.

“Apart from that we also realised that they were also having some challenges with the banks for example. So even raising money or even when monies were paid into their account it has its own challenge. So a special arrangement in connection with PBC has been made where the amounts are able to get to their district offices and then their agents out there to be able to buy cocoa for them.

“Of course when they raised their CTROs that is the receipt for cocoa purchases, a special arrangement has also been put in place to ensure that they’re able to get payment for that as early as possible in order for them to turn around the money available to them.”

He continued that while the PBC still owes COCOBOD some money, “ there’s still the need for us to ensure that they’re able to go out there and do business.”

Thus COCOBOD is also assisting PBC “streamline some of their activities and we talked about how Golden Beam was making a profit.

“This was not the case but because we realised that it was one of the things that was haemorrhaging the institution, there was the need to have some understanding that would bring them back to the profit line such that they would be able to make profit and they will not have to now send money to the hotel in order for the hotel to operate whereas they could be making profit to support their business.”

He had earlier stated that the PBC losing such a large market share was partly due to strong competition from independent cocoa-buying companies.

General News of Tuesday, 30 January 2024

Source: theheraldghana.com