Former President John Dramani Mahama has called on the government to reverse the Value Added Tax (VAT) being charged on electricity consumption.

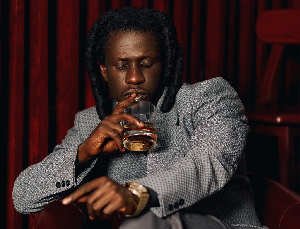

Speaking at the climax of a health walk held in Kumasi on Wednesday, January 24, 2023, Mr Mahama took a swipe at President Nana Addo Dankwa Akufo-Addo and finance minister Ken Ofori-Atta over undue taxes on the population.

“We introduced VAT Law a long time ago but every government that has come never charged VAT on electricity. Today, Jack Toronto and his kid brother are saying you have to pay VAT when you use electricity,” he stated.

The walk in Kumasi organised by the National Democratic Congress was aimed at sensitising Ghanaians about the 24-Hour Economy policy promised by Mr Mahama who is the party’s flagbearer for 2024.

Mr Mahama during his address cautioned the government to rescind the VAT on electricity or risk the wrath of Ghanaians.

“If they know what is good for them, they should reverse the VAT they want to charge on electricity use because Ghanaians will not agree today or tomorrow,” he said.

Background:

The Akufo-Addo government has come under intense scrutiny after a letter from the Ministry of Finance showed that the government has been charging Value Added Tax (VAT) on a section of electricity consumers in the country since the beginning of January 2024.

The letter, which was signed by the Minister for Finance, Ken Ofori-Atta, and addressed to the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO), indicated that the VAT would be for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units.

It said that VAT forms part of the implementation of the country’s Covid-29 recovery programme and should be charged starting from January 1, 2024.

“As part of the implementation of the Government's Medium-Term Revenue Strategy and the IMF-Supported Post Covid-19 Programme for Economic Growth (PC-PEG), the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units in line with Section 35 and 37 and the First Schedule (9) of Value Added Tax (VAT) Act, 2013 (ACT 870) has been scheduled for implementation, effective 1st January 2024.”

“For the avoidance of doubt, VAT is still exempt for "a supply to a dwelling of electricity up to a maximum consumption level specified for block charges for lifeline units" in line with Sections 35 and 37 and the First Schedule (9) of Act 870,” the letter further clarified.

GA/SARA

General News of Thursday, 25 January 2024

Source: www.ghanaweb.com