Accra, June 15, GNA - Nana Otuo Acheampong, Head of Faculty of Corporate Reporting and Investment Banking at National Banking College, on Tuesday called for the merger of the four financial regulators into single unit regulatory regime.

He said a single regulatory regime would eliminate operational fragmentation; create environment for competitive neutrality, ensure flexibility, generate economies of scale and improves accountability of regulation.

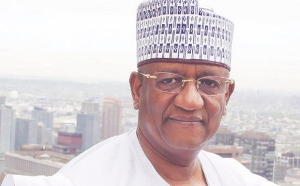

Nana Acheampong made the call at a public forum organized by the Ghana Academe of Arts and Science (GAAS) on the general theme: "Governance in Ghana; Challenges to Administrative Justice, Anti-Corruption and Access to Justice," in Accra.

He said that currently the Ghanaian financial services industry has broadly been categorized into four functional lines, the banking, insurance and capital markets and the pension sectors. Consequently, there are four regulators for the single industry in Ghana, playing various roles, but all in an effort to achieve four unique objectives.

Nana Acheampong said objectives include safety and soundness of particular financial institutions, mitigation of systemic risk, fairness and efficiency of markets and the protection of customers and investors. He explained that the state has set four separate institutions - Bank of Ghana to regulate the banking industry; Securities and Exchange Commission to regulate the capital markets sector; National Insurance Commission for the insurance industry and national Pensions Regulatory Authority for the pension industry.

Speaking on "The Role of Civil Society and Private Institutions in Fighting Corruption," Nana Acheampong said in the financial services industry, the main driver of corruption due mainly to the knowledge gap in the regulatory regime.

"The regulated may be ahead of the regulator because of the lack of the knowledge capacity of the latter," he said. Nana Acheampong said that an Intergovernmental Action Group Against Money Laundering in West Africa report published last months identified 15 African countries measuring high on the corruption scale. The countries include Liberia, Ghana, Cote d'Ivoire, Guinea, Bissau, and Benin- Nigeria score 87 percent; Ghana 57 percent; Cote d'Ivoire 55 percent; Liberia 44 percent and Benin 40 percent. Nana Acheampong called for collaboration among practitioners to police the financial sector and clean it of corruption. Professor Lawrence A. Boadi, Vice President of GAAS chaired the forum which was attended by officials from Ghana Immigration Service, Academe, Journalists, Students, Governance Institutions and cross section of the public. 15 June 10

General News of Tuesday, 15 June 2010

Source: GNA

Establish single financial sector regulatory regime

Entertainment