President Akufo-Addo says persons found guilty in the collapse of the seven indigenous banks will be made to face the full rigours of the law.

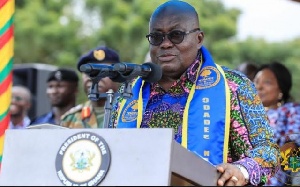

Speaking at the 80th anniversary celebration of the Presbyterian Boys’ Senior High School (PRESEC) in Legon over the weekend, he said, “Those responsible for the sequence of activities that led to the banking crisis will face the full brunt of the law if they are found to have broken the law.”

Even though he did not specifically mention possibility of the culprits serving jail terms, analysts and legal luminaries have hinted that those found guilty in the collapse of The Royal Bank, Beige Bank, Sovereign Bank Limited, Construction Bank, uniBank Ghana Limited, UT Bank and Capital Bank are likely to be prosecuted.

He attributed the collapse of the banks to cutting corners, circumvention of the laws, flouting and non-adherence to regulations and complicity of senior officials of the Bank of Ghana.

President Akufo-Addo insisted that “it’s not right that the overwhelming majority of ordinary Ghanaians should pay for the actions of a greedy few without sanction.”

This, according to him, prompted the current Governor of the Bank of Ghana (BoG), Dr. Ernest Addison, to institute a number of prudent measures to save and sanitise the banking industry.

“To protect the depositors of the seven defunct banks, the government, through the Ministry of Finance, has had to issue bonds to the tune of some GH¢8 billion in favour of GCB Bank and the new Consolidated Bank- the banks that took over the operations of the seven failed banks,” he said.

That, the president stated, was in addition to liquidity support of some GH¢4.7 billion that had earlier been provided to the affected banks by the Central Bank prior to the revocation of their licences.

He revealed that a total of GH¢12.7 billion of public funds had been injected into the failed banks, which were merged into an entity known as Consolidated Bank Ghana Limited (CBG).

With that, he indicated that depositors’ monies have been safeguarded, job losses have been minimised, and a strong set of indigenous banks is being born.

“I have no doubt that if these measures had not been taken, the banking system would have been seriously compromised, with dire consequences for depositors and their savings,” he added.

He, therefore, called for a vibrant banking sector that can help mobilise resources to finance Ghana’s industrial, agricultural and economic transformation.

General News of Monday, 17 September 2018

Source: dailyguideafrica.com