Adidome, Nov. 23, GNA - The North-Tongu Rural Bank made a modest profit of 97,191,599.00 cedis for the third consecutive year at the close of 2002.

This, however, represented a decrease of 0.08 per cent over the 2001 figure of 97,270,132.00 as a result of increases in operating expenses and a fall in interest rates on treasury bills, as total income earned on treasury bills plummeted from 268,685,000.00 cedis in 2001 to 159,427,000.00 cedis in 2002.

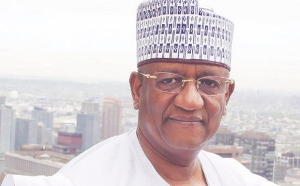

Mr Henry Tornyie, Chairman of the Board of Directors announced this at the Bank's 20th Annual General Meeting (AGM) at Adidome on Saturday.

Nonetheless, the Director said the bank over the year under review strengthened its solvency, increasing its net-worth by 48.4 per cent from 168,091,000.00 cedis in 2001 to 276,179,000.00 cedis in 2002.

Mr Tornyie said similarly, the paid up capital of the bank also showed an increase of 94.3 per cent - 52,001,000.00 in 2001 to 101,047,000.00 in 2002, thereby meeting the new minimum capital requirement of 100 million cedis for existing rural banks.

He said the performance of the bank had resulted in a higher capital adequacy ratio, which is now 38 per cent above the minimum requirement of six per cent. The Bank, which operates along the lower banks of the Volta Lake with accessibility problems, has two Agencies at Juapong and Battor, with plans to start a mobilisation centre in Ho soon.

Mr Tornyie, who described the year under review as "very satisfactory" said total assets increased from 2,276,665,00 cedis in 2001 to 2,923,372.00 cedis in 2002 showing an increase of 28.4 per cent.

He said 1,398,677,000.00 cedis out of the bank's total assets for the period was made up of cash and bank balances and investment in government securities, while investments increased from 789,453,868.00 cedis in 2001 to 905,712,288.00 at the end of the review period representing a 14.7 per cent increase.

Mr Tornyie said loans to projects under the agricultural, trading, education, transport, cottage industries sectors stood at 1,219,822.00, which was an increase of 43.2 per cent over the 2001 figure.

He, however, expressed regret about loan recovery resulting in bad debt by 78.9 per cent from 48,435,000.00 cedis to 86,565,000.00.

Mr Tornyie said the bank had therefore, engaged the services of a professional Debt Collector to help in retrieving credit to clients.

He said as part of its social responsibility programme the bank gave a bankers guarantee of 86 million cedis in favour of the Adidome Water Project, which was almost completed and also offered a million cedis each to the Adidome, Mafi-Kumasi and Juapong and Aveyime secondary schools to purchase books to stock their libraries.

Additionally, a scholarship scheme would be instituted for needy students in the area, he said On the way forward. Mr Tornyie said the bank would seek to improve on quality of loan portfolio, maintain a high level of secondary reserves and pursue a "vigorous deposit mobilisation drive" part of which would be the expansion of the bank's 'Susu' Scheme.

An agreement was reached to plough back dividends to increase the capital base of the bank.

Mr Nicholas Ahiadorme, North-Tongu District Chief Executive (DCE) in a message to the meeting praised the bank for assisting the District Assembly in the payment of petty expenses, organisation of seminars and donations to various communities during their social and fund raising activities.

He suggested that loans be processed faster and lending rates made more attractive, adding that the bank should support projects such as snail farming grass cutter rearing and mushroom production among others to broaden the production base of the district.

Journalists were taken round the 500 million cedi Midway Industries at Adidome, which produces gari for export, a piggery, vast cassava farms, and cattle projects with support from the bank.

Mama Mewornu II, Acting Managing Director said the company contracted a 20 million cedi loan from the North-Tongu Rural Bank to expand its vegetable farms for the local market.

Regional News of Monday, 24 November 2003

Source: GNA

North-Tongu Rural Bank makes profit

Entertainment