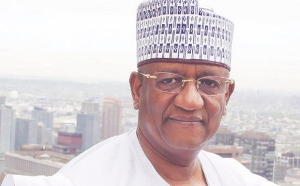

The Omanhene of Essikado Traditional Area in Western Region, Nana Kobina Nketsiah V, has reminded the Insurance Industry to embrace digitization to be part of the global economy and discharge their watchdog role in society effectively.

He said most countries the world over, have taken advantage of digitization to transform their businesses with greater value.

"As Insurers, you are the watchdog of society so you either digitize or be left behind", Nana Nketsiah V cautioned.

Nana Kobina Nketiah V was delivering a keynote address as the Special Guest of Honour at the opening ceremony of the 5th Ghana Insurance Brokers Association (GIBA) annual conference and exhibition in Takoradi.

The conference, which is being attended by about 80 delegates from the Insurance Industry across the country, is on the theme, "Embracing Digitization Transformation and Innovation in Insurance Business".

Nana Kobina Nketsiah V noted with concern that cultural barriers were being swept under the carpet by modern technology and stressed the need to shape Ghana's culture to fit into the emerging trend.

He charged Insurance Brokers to look at the technical nuances in the Insurance industry by adopting technology and digitization to fashion out innovation which would be more relevant to customers and the entire citizenry.

Nana Kobina Nketsih V, however, commended efforts made by the nation to digitize the Driver Vehicle and Licensing Authority (DVLA), the Ghana Postal Services (GPS) among others and called for retraining of the country's talented workforce to acquire the skills in technology and digitization.

President of Ghana Insurance Brokers Association (GIBA), Mrs. Lena Adu-Kofi reminded companies of their responsibilities of reaching out to customers with their products and service in most satisfactory and profitable manner.

"The emergence of several technological innovations have vastly affected the lifestyle of the entire world. In recent times, social media likely more than anything else has significantly impacted most of our everyday life".

According to her, GIBA currently runs an active website, a Facebook page and several WhatsApp group pages which have made it simpler and easier to do business in a global village.

Mrs. Afu-Kofi who is also the Chief Executive Officer (CEO) observed that with the low level of insurance penetration in Ghana the main industry players have a greater responsibility of educating majority of Ghanaian through digitization as the new marketplace.

She expressed GIBA's readiness to embrace President Akufo-Addo's call for all sectors of the economy to be digitized adding that as an insurance industry, it must take advantage of technologies available and develop apps and short-codes to help check against double insurances to authenticate drivers' licenses among others

Mrs. Adu-Kofi charged Brokers and Insurers to come up with some software and utilize the technologies available to enhance their business strategies and operations.

She nourished the hope that the conference would educate how Brokers could utilize the digital innovations in life insurance especially for those who do not seem interested in life businesses.

She advised that as Insurance entities they could not step into a new regime without looking at the risk aspect of it hence, the conference will discuss cyber risk Insurance and provide insurance cover for businesses to thrive.

The Commissioner of Insurance Mr. Justice Ofori who chaired the conference bemoaned that only 23% of businesses in Ghana have embraced digitization in their operations.

He said digital innovation improves client services and enhanced business transactions.

Mr. Ofori realized the need for insurance technology to dominate discussions at the national level to maximize efficiency in labour and solve problems.

He said the emergence of digital innovations must give rise to new opportunities for additional premiums in the Insurance industry.

Regional News of Sunday, 25 March 2018

Source: Daniel Kaku

Essikado Paramount Chief charges Insurance Industry to embrace digitization

Entertainment