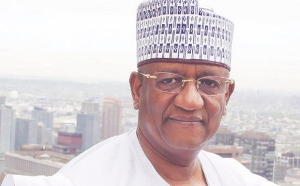

Access Bank Ghana has drawn the curtain on its 2022 series of capacity-building workshops for Small and Medium Scale Enterprises (SMEs), at the Ho Technical University in the Volta Region. The workshop was on the theme “‘Boosting Digital Skills for Emerging Opportunities’, in line with the Bank’s commitment to supporting SMEs in the country to thrive. Speaking in an interview ahead of the workshop, Managing Director of Access Bank Ghana, Olumide Olatunji was excited about the impact Access Bank is making on the SME sector in the country. He said “We strongly believe that increased support to SMEs will translate into an improved socio-economic situation of the country. SMEs are core to Ghana’s economy therefore supporting them to expand and grow will mean more jobs and more opportunities. To further contribute to building the sector, Olumide said, “We have developed a digital cashflow lending platform to grant SMEs easy access to funding in real-time. As part of our support for the sector, Access Bank has developed a web-mall that will give small businesses access to a market beyond their geographical location”. Delivering his opening remarks at the workshop, Kafui Bimpe, Group Head for Business Banking at Access Bank Ghana told participants that the SME capacity building train had traveled the length and breadth of Ghana this year, to engage with various SMEs on best solutions the Bank could offer them. “We have been to Tamale, Techiman, Kasoa, Takoradi, and Koforidua and we are here in Ho today in a bid to support SMEs’ growth”. Kafui noted that “Small and Medium Scale Enterprises (SMEs) form the bedrock of many developing countries, including Ghana. However, many SMEs across the globe struggle to survive because of the prevailing global happenings. He said there is an urgent need, to mobilize local entrepreneurs to face the challenges of national development and channel their efforts toward sustained economic growth. “I agree with the assertion of Mugisha, UNDP Economic Advisor for Ghana and the Gambia who noted that “If businesses, especially SMEs are provided with the needed support to adopt best practices, particularly in the use of digital solutions, it could go a long way to increase their productivity and resilience to future challenges”. “At Access Bank we realize the need to equip SMEs to be better prepared for the current business trend. Our experience has shown that digitalization offers tremendous opportunities to increase productivity and create jobs” Kafui explained. A facilitator from Open Labs, Peniel Amankwah who led participants through hands-on training on using digital skills, advised them to adopt digital technology in the running of their everyday businesses. She noted that many SMEs are losing great opportunities because they are not technologically savvy. She said many underutilize the power of their smartphones which is a good tool to enhance their knowledge on new trends to business growth and expose them to more business ideas”. Peniel encouraged SMEs to make use of digital technology, to remain relevant and successful in their businesses. As a go-to Bank for SMEs, Access Bank remains committed to its promise of providing more than banking to its valued customers. The Bank’s leadership and commitment towards SMEs in the country have been recognized by various awards including Most Innovative SME Banking Brand by the Global Brands Magazine and Market Leader for SME Banking by the Euromoney Award. Over the years, the Bank has developed a deep understanding of its customers, delivering excellent products and services to empower them to achieve more through financial inclusion.

Entertainment