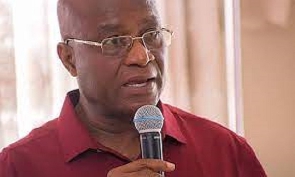

Parliamentary Affairs Minister Osei Kyei-Mensah-Bonsu has said that in their efforts to revamp the economy as parliamentarians, there is a need to understand the importance of gender equality and economic growth.

Giving his opening remarks at the post-budget workshop held in parliament, Mr. Mensah Bonsu emphasised that applying a gender lens to the budgetary process helps to understand the impact of the budget and prioritise policies that make a positive contribution to gender equality.

He said failing to adopt gender-responsive policies risks long-term effects on macroeconomic stability that will cement women’s disadvantage and harm prospects for recovery.

Citing an example, he said it would be very interesting for them as parliamentarians to have access to a gender impact assessment that can help identify how the new tax or spending initiatives contained in the budget impact gender equality.

“I would like to entreat us all to scrutinise the budget with a gender lens to ensure gender equality.”

The Member of Parliament for Suame explained that last year, Parliament passed the Tax Exemption Bill into law, which sets clear eligibility criteria for tax exemptions and provides for the monitoring, evaluation, and enforcement of exemptions to ensure that they are used for the intended purposes.

He mentioned that there is a need for further scrutiny to identify gaps in the regime and improve on them, and the government is ready to engage stakeholders in that regard.

He revealed that, according to the Ghana Statistical Service, gross capital formation, which is referred to as gross domestic investment by both the government and private firms, recorded negative growth rates of 7.3% and 10.2% in the first and second quarters of 2023, respectively.

He urged Parliament to request an ex ante impact assessment report when new policies and initiatives are proposed.

He said a case in point is when the government introduced an import tax of 20% and VAT of 15% on sanitary pads, which generated a lot of debate in the public discourse. He questioned the short-, medium-, and long-term impacts of that policy.

He asked if it was going to help local producers expand their productive capacity or what kind of support local producers require to meet local demand. How was thepolicy going to affect girl-child education.

He advised that,going forward, there is a need for Parliament to demand impact assessment reports to enable them to scrutinise the budgets and other policy documents.

Politics of Tuesday, 21 November 2023

Source: rainbowradioonline.com

There is a need to understand the importance of gender equality and economic growth – Majority Leader to MPs

Entertainment