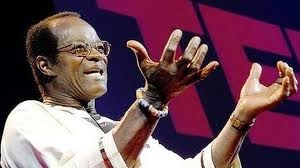

Government must cut its expenditure and lessen the tax burden on Ghanaians, Professor George Ayittey, a visiting senior fellow at the Institute of Economic Affairs (IEA) has said.

Professor Ayittey, who was lead speaker at a forum organised by the IEA on the state of the Ghanaian economy, said government’s spending culture is worrying and has created a deficit that it wants to bridge through excessive taxation.

“The government is hungry for revenue, and it is slapping taxes on anything that moves. Import duties, VAT, among others have all gone up, and we have reached a point where we must tell the government, ‘enough of these vampire taxes!’ Ghanaians are overtaxed. If government wants people to tighten their belts, the government must tighten its own belt and cut the excessive spending habit,” he said.

The concerns of Professor Ayittey are shared by many individuals and institutions such as the Economic Intelligence Unit, which last week described the country's fiscal state as a “mess” that must be tackled head-on.

Presently, Ghana’s total public debt has shot up to GH¢43.9billion, which is about 49.5% of GDP. The government’s borrowing trend recently prompted global credit rating agency Fitch to downgrade the country’s credit rating from B+ to B.

Fitch said the budget deficit target of nine percent of GDP is not likely to be met as government struggles to boost taxes and rein-in spending.

In July, government imposed additional import levies of 1-2 percent on some agricultural inputs, including farm machinery, fishing nets, and outboard motors; and also on dairy products, book-binding machines, and energy-saving bulbs.

An additional profit tax, in the form of the fiscal stabilisation levy, was also imposed on banks, insurance companies, breweries and telecom operators. “The government is digging its own grave. Slapping more taxes doesn’t only hurt individuals but businesses as well, as taxes raise the cost of doing business in the country. So instead of raising more taxes, the government should look at curtailing its own expenditure.

“We have many government agencies which are running parallel to other institutions -- such as CHRAG and EOCO -- which are creating bureaucracies in government. And because of the many institutions of state, the wage bill has grown to a gargantuan level.

“The government now employs about 700,000 workers, excluding about 97 deputy and cabinet ministers and other public officials. The country’s wage bill alone consumes 70% of government’s budget.

“So we have a situation where the country is drifting and we don’t know where we are going. The structural deficit problem and corruption means that the country is in trouble,” he said.

The IMF has cautioned Ghana over its “ballooning” wage bill, which it said if untamed will increase the country's debt to levels that pose a risk to its transformation agenda.

Since implementation of the Single Spine Salary Structure, the annual public wage bill has shot up from the region of GH¢1.7billion to GH¢9billion as of 2012, and is projected to rise to GH¢11billion by end-2013.

The country’s budget deficits have been above 5 percent in all but one year since 2006. It peaked twice in the election years 2008 and 2012, ballooning to 8.5 percent and 11.8 percent of GDP respectively.

The fallout of this deficit surge in election years is that debt-service costs have increased sharply soon after. Between 2006 and 2007, interest spending plummeted from 16.9 percent of tax revenue to 12.7 percent, but spiked to 15.8 percent in 2008, 22.2 percent in 2009 and 22.9 percent in 2010.

In 2011, when the deficit shrank to 4 percent of GDP, interest cost narrowed to 16.5 percent of tax revenue. It has however started to rise again with the sharp spike in the 2012 deficit: it hit 19.5 percent of tax revenue last year and 33.4 percent in the first eight months of 2013.

Professor Ayittey insisted the government’s spending culture is taking the economy into an abyss and must be watched.

Business News of Monday, 11 November 2013

Source: B&FT

‘Vampire taxes’ killing economy - IEA fellow

Entertainment