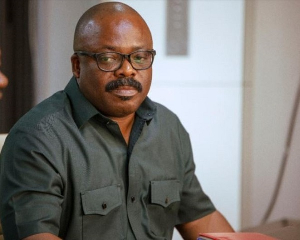

A Senior Economist at the United Nations Development Programme (UNDP), Jacob Assa, has underscored the growing importance of sovereign credit ratings in accessing international development financing.

According to him, many African countries, including Ghana, have transitioned to middle-income status, making them ineligible for concessional financing and aid.

He made the remarks on the sidelines of the National Workshop on Sovereign Credit Ratings in Tema on September 11, 2025.

Why Ghana must deepen understanding of credit ratings - UNDP

This shift, he explained, has pushed nations to rely heavily on international capital markets, where credit ratings serve as a key determinant of creditworthiness.

“The way these markets assess your creditworthiness is through a credit rating,” he said, noting that agencies such as Standard & Poor’s, Moody’s, and Fitch each employ distinct methodologies.

Assa stressed that while Ghana is relatively advanced in its understanding of these processes, continuous learning remains essential.

To this end, the UNDP has assembled a consortium of 15 former experts from leading rating agencies to provide training and advisory services to governments.

“It’s not enough to have a good economy. It’s important to tell a strong narrative about your economy, to give the right data, and to improve coordination between government ministries talking to the agencies,” he added.

He praised Ghana’s existing ad hoc committee on credit ratings, which brings together the Bank of Ghana, the Ministry of Finance, and other institutions, but suggested it could be made more systematic with standardised procedures and stronger communication strategies.

By strengthening capacity in data presentation, proactive engagement, and constructive responses to agency feedback, Assa noted, Ghana can better position itself in the global financial market.

“The team is already excellent but there is always room to do an even better job in telling the story of Ghana,” he concluded.

Watch the video below:

SSD/MA

Business News of Thursday, 11 September 2025

Source: www.ghanaweb.com