The Public Interest and Accountability Committee (PIAC) is making a subtle proposal to the government to consider closing down the Saltpond Oilfields as production continues to dwindle thus making the field commercially not viable.

“There is the urgent need for a critical appraisal of the viability of the continuous operation of the Saltpond Oil field against the backdrop of low crude oil price,” PIAC recommended in its 2014 Annual Report, which was launched in Accra last Tuesday.

The Report stated: “ With crude oil price projected to hover around US$52 in 2015, the business case for operating the Saltpond field in 2015 has been further weakened considering the fact that the oilfield produced a barrel of crude oil at the cost of US $31.22 in 2014.”

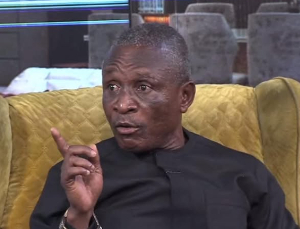

The Report, which was presented by the Chairman of the Committee, Professor P. K Buah- Bassuah, also urged the Saltpond Oil field ,the Ministry of Finance and the Ghana National Petroleum Corporation (GNPC) to resolve the discrepancies in the production and lifting figures from the field so as to help determine the actual royalties that ought to have been paid as well establishing the true performance and true state of affairs at the Saltpond Field.

The 2014 Annual Report was the 7th report of the PIAC since its inauguration in September 2011. According to the Committee, this Report should have been published in March this year, but the timelines could not be met due to resource constraints.

PIAC was established under the Petroleum Revenue Management Act 2011, (Act 815), to, among other things; clothe citizens with oversight responsibilities regarding the management of petroleum revenues.

Prof. Buah -Bassuah, indicated that there were discrepancies in the crude oil figures from the Saltpond Field. He explained that while figures obtained from the Saltpond Offshore Production Company Limited (SOPCL) pointed to a marginal increase in the year – to year production of crude oil , figures published by the Ministry of Finance(MoF) and GNPC indicated that production had declined in 2014.

He added, “Similarly the lifting figures from the SOPCL and GNPC sources differed with SOPCL reporting increment in lifting while MoF and GNPC indicating otherwise.”

According to him, the steady decline in crude oil prices during the second half of 2014 did not have any serious impact on expected petroleum revenues for the year 2014 as the benchmark revenue was exceeded.

Professor Ivan Addae- Mensah, Board Chairman of the Petroleum Commission, stressed the need for PIAC to effectively collaborate with the Petroleum Commission so as to share ideas.

On the issue of the Saltpond Oilfield, Prof. Addae –Mensah revealed that a lot had been discussed regarding the way forward but declined to give details.

Participants at the launch expressed dissatisfaction with the way the Annual Budget Funding Amount (ABFA) in 2014 had been expended, arguing that some of the monies allocated to some projects were so high and needed to be scrutinised.

Business News of Monday, 28 September 2015

Source: Public Agenda