Dr. Richmond Atuahene, a banking consultant, has suggested that the GH¢15billion Financial Stability Fund (FSF) – which was set up to provide liquidity support to the banking sector following the Domestic Debt Exchange Programme (DDEP) – can instead be channeled to support banks’ recapitalisation, especially locally-owned banks.

He said due to excess post-DDEP liquidity and information asymmetry in the banking system, banks may not be as severely constrained as they would otherwise have been; therefore they may not require significant liquidity support from the FSF.

Citing the example of Jamaica, he said: “… the establishment of a Jamaican Financial Sector Support Fund of US$1.2billion to support banks and other institutions that participated in the Jamaica domestic debt exchange was not utilised to support stability of the financial sector because there was no need for a financial stability support fund.

“Ceteris paribus, or all things being equal, the Bank of Ghana could use the same fund for capital support looking at the magnitude of capital losses to the Ghanaian-owned banks which will be required to recapitalise after DDEP capital losses,” he explained in a paper on the subject, co-authored with financial consultant K.B. Frimpong.

Despite falling to GH¢157.9billion at the end of December 2022 from GH¢174.8billion in the previous month, the industry’s total deposits had grown by 30.4 percent on an annual basis; thus driving total assets to GH¢209.4billion.

Also, the industry’s capital adequacy ratio (CAR) – adjusted for the regulatory reliefs, was 15.7 percent in December 2022 and was well above the minimum of 10 percent. It was reduced from 13 percent in December 2022 as part of measures by the central bank to mitigate the DDEP’s impact on lenders.

Nonetheless, there have been heightened need to recapitalise, spearheaded by foreign banks operating in the country.

A fortnight ago, Standard Bank and First Rand Bank – both based in South Africa – have revealed their plans to recapitalise their operations in Ghana. Standard Bank has reportedly reserved 1.5 billion South African Rand (ZAR) – approximately US$81million for impairments – to account for possible losses resulting from the DDEP.

Also, Nigerian-owned Zenith Bank has revealed that it set aside US$267million to account for its holdings of bonds in Ghana, with the lender saying the debt programme has resulted in significant impairment expense.

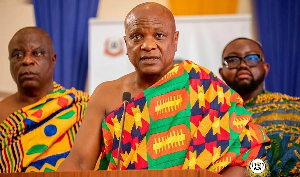

At a press briefing at the end of the most recent Monetary Policy Committee meeting, Bank of Ghana Governor Dr. Ernest Addison stated that work continues to progress on finer details of the fund.

Already, the World Bank has pledged US$250million toward ensuring solvency – not liquidity support – for the banking system. This is in addition to a 2.5 percent provision in the 2023 budget for the fund.

Business News of Monday, 3 April 2023

Source: thebftonline.com

Improved liquidity could see FSF support banks' recapitalisation efforts

Entertainment