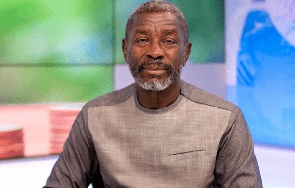

The Founder and former Chief Executive Officer of defunct Unique Trust Bank, Prince Kofi Amoabeng, has challenged government to make its stance clear with regard to the intended Domestic Debt Exchange Programme.

According to him, the current posture of government on the programme is only brewing further economic uncertainties and therefore wants government to openly admit its fault for the poor decisions taken amid the current economic challenges.

“The government should come out after he [Finance Minister - Ken Ofori-Atta] is done with all needed research and say this is the way we’re going, but not to be changing its position. Because pensioners are talking or complaining, then you say this is not part of it…why?” he said this in interaction with Joy Business.

“Get a grasp of the full facts and come out one time and explain to the people that this is what we are doing. You cannot just throw information at the people. We know you can make mistakes but the information should be backed by some facts, and then you apologise to Ghanaians for any error made rather than just be telling us stories…really?” Prince Amoabeng is quoted by myjoyonline.com

Meanwhile, a number of investors who will be affected by the debt exchange programme are being led by Private Legal Practitioner, Martin Kpebu to engage the government over the inclusion of individual bondholders in the debt exchange programme.

Although individual investors were initially not part of the debt restructuring, the government decided to include individual bondholders in the debt exchange programme some days after the exemption of pension funds from the programme.

The Domestic Debt Exchange Programme is a key requirement ahead of Ghana securing a Board-Level Agreement with the International Monetary Fund under an Extended Credit Facility for an amount of $3 billion to restore macro-economic stability.

MA/FNOQ

Business News of Tuesday, 10 January 2023

Source: www.ghanaweb.com