Director of Centre for Coin Liberty at the Institute for Liberty and Policy Innovation (ILAPI), Nathaniel Dwamena, has reiterated the need for Ghana to be in readiness for blockchain technology.

He maintained that blockchain technology could be the future for Ghana in fighting corruption, dealing with electoral fraud and initiating development in all sectors of our economy.

The researcher stated that the organization is putting in place measures that would ensure that Ghana is well prepared for the technology, so we are not taken by surprise.

Appearing on Frontline on Rainbow Radio 87.5Fm, he averred that blockchain technology could increase fairness and efficiency in our governance structure.

Nathaniel Dwamena said the rise in cryptocurrency had forced several central banks across the continent to introduce policies on digital currencies.

The Bank of Ghana, in August 2021, announced that it partnered Giesecke+Devrient (G+D) to pilot a general-purpose Central Bank Digital Currency (retail CBDC) in Ghana, West Africa.

The BoG said G+D is providing the technology and developing the solution adapted to Ghana’s requirements, which will be tested in a trial phase with banks, payment service providers, merchants, consumers and other relevant stakeholders.

He said the centre is currently examing ways through which the CBDC could work hand in hand with cryptocurrency.

Nathaniel Dwamena explained that the BoG could have several avenues in implementing the CBDC and learn from examples of countries that had done the same.

He said central banks around the world are exploring the introduction of digital money as legal tender, and Ghana could also join but must learn from best practices, he added.

He also told the host that CBDCs could provide financial services to people who previously did not have bank accounts, particularly if they are designed for offline use, as well as aid in the distribution of targeted welfare payments, particularly during sudden crises such as a pandemic or natural disaster.

Nathaniel Dwamena , however, disclosed that despite the several countries that have implemented it, the majority had been a failure, and Ghana must take a cue from these stories.

"However, risks and challenges must be considered before issuing a CBDC. Authorities will need to improve access to digital infrastructure, such as phone service and internet access.”

He also stated that central banks will need to develop the expertise and technical capacity to manage data privacy risks, including potential cyber-attacks.

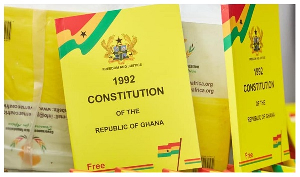

Nathaniel Dwamena believes that countries must strengthen their national identification systems in order for know-your-customer requirements to be more easily enforced.

He emphasized that this is a new technology, and Ghana must position itself. We need to integrate our systems, build trust, and protect people by ensuring that this system is safe to use. We recommend that the E-cedi and digital exchanges be usable. This would increase trust in and use of the system.”

Business News of Tuesday, 8 November 2022

Source: rainbowradioonline.com