Business News of Wednesday, 14 October 2020

Source: www.ghanaweb.com

GH¢110m yet to be paid to owners of failed Savings and Loans companies – BoG

The Bank of Ghana (BoG) has revealed that a huge part of the claims by depositors of the failed Savings and Loans Companies have been paid, leaving only part belonging to owners of these institutions.

Second Deputy Governor of the BoG, Elsie Awadzi, said on Tuesday, October 13, 2020, at a media sensitisation programme that only GH¢110 million out of the total claims of GH¢6.5 billion is left to be paid.

“Out of the GH¢6.5 billion in deposit claims as validated by the Receiver of the failed SDIs [Special Deposit-taking Institutions], an amount of GH¢6.39 billion has been paid in cash so far to these depositors, leaving a balance of 110 million cedis being claims of related parties of the failed institutions,” she said.

She explained that these third parties included the shareholders and directors of the defunct institutions who themselves were very involved in the management and control of these institutions.

“So, they have to wait at the end of the cue. If any assets are realised they would be paid,” she said.

The media sensitisation event brought together key players in the sector and presented a rare opportunity for the SDI associations to better explain their operations to the media.

It also enabled the media to ask appropriate questions of the key players in the sector and provide feedback to SDIs as to what the public thinks of their service.

Elsie Addo Awadzi said the clean-up of the SDI sector was necessary and was done according to the law.

“First of all, the laws under which we regulate them, demands as a matter of law that we close them down when they become insolvent and are unable to pay their depositors. That is the law,” she stressed.

The BoG last year revoked the licences of 192 insolvent microfinance companies.

In addition, licences of another 155 insolvent microfinance companies that have ceased operations were revoked.

“These actions were taken pursuant to section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a bank or Specialised Deposit-taking Institution (SDI) where the Bank of Ghana determines that the institution is insolvent or is likely to become insolvent within the next 60 days,” the BoG said in a press statement dated May 31, 2019.

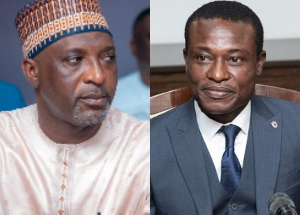

Consequently, the BoG appointed Eric Nipah as Receiver for the specified institutions.