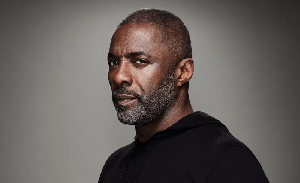

Governor of the Central Bank, Dr Ernest Addison, has said it is in discussions with the government to assess the viability of the state-owned National Investment Bank.

According to him, the discussions are expected to conclude somewhere in 2024 after which the fate of the NIB would be determined by government.

Addressing journalists at the 113th MPC press briefing on July 24, the BoG Governor said issues regarding NIB and other under-capitalised institutions now form part of a financial sector strategy under Ghana’s current IMF-supported programme.

“The NIB is one of the banks that we will make that assessment on, to ascertain whether it is still viable or not. If it is viable and the government can find money to recapitalise it, then Yes. But if it is not viable, then, obviously, we will have to find a different use for that instrument,” Dr Addison said.

“These are ongoing discussions between us and the international partners and I believe that in the next year or so, we will get a clearer sense of how to handle those particular institutions that are very weak,” he added.

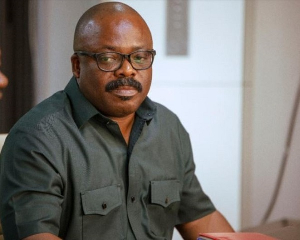

Under Ghana’s 17th IMF programme, the Central Bank has committed to addressing the insolvency of under-capitalised institutions including the NIB. The move also forms part of efforts to tackle the long-standing under-capitalisation of several special deposit-taking institutions (SDIs) following the banking sector clean-up exercise.

Following the recapitalisation of some banks operating in the country in the wake of the banking sector clean-up exercise, state-owned National Investment Bank which was on the brink of insolvency, did not undergo recapitalisation.

MA/NOQ

Watch the latest edition of BizTech and Biz Headlines below:

Business News of Tuesday, 25 July 2023

Source: www.ghanaweb.com