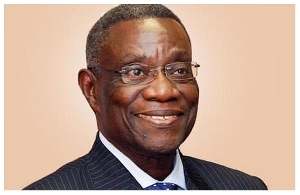

Artificial intelligence (AI) will become the most important differentiating factor between financial services providers that will succeed and those that will struggle in the new era of global finance, Austin Kwesi Okere, Founder and current Chairman of CWG Plc – a leading systems integration company in sub-Saharan Africa, has affirmed.

In his estimation, AI will play a pivotal role in critical areas like product development, corporate governance and fraud prevention, which have gained even greater significance in light of recent developments in the broader economy. Pointing out that bad actors will seek to use the tool to their advantage, he said: “When it comes to trusting banks, it’s all about safety – keeping your money secure from risks, fraud and cyber threats.

“People often lose sleep worrying about whether their funds are safe from unauthorised access or impersonation. But things keep changing, and now artificial intelligence poses a new threat by making it easier to fake identities. So, we’ve got to up our game and use that very same tool to improve security.

“Security in banking is always evolving and our job is to bring in the latest and best practices to protect your money. As the world gets more complicated, these safety measures become even more crucial. CWG leads the way in creating these solutions,” he added.

His comments, which came during the launch of the 20th anniversary of CWG’s operations in Ghana, were against the backdrop of the growing relevance of AI across every sector of the economy. The global AI market is expected to reach a value of US$1.35trillion by 2030. AI also has the potential to contribute US$15.7trillion to the global economy in that same year.

Already, the Bank of Ghana’s fraud report has revealed that the total loss value recorded by banks and specialised deposit-taking institutions (SDIs) due to fraud in 2022 was approximately GH¢56million while global financial sector losses to fraud are often in trillions of US dollars annually.

On a similar tangent, the Managing Director at CWG Ghana and Vice-President for its regional operations, Harriet Attram Yartey, pointed out how technology has created a unique opportunity for local institutions to experience exponential growth.

She highlighted that in the past, the cost was a significant obstacle for firms aiming to adopt cutting-edge technology. However, CWG’s solutions have democratised access to technology, resulting in substantial cost savings through enhanced efficiency and reduced risks associated with potential digital security breaches.

“We have successfully shifted the perception that technology is prohibitively expensive, and our customers are now expanding their operations while reaping the benefits of these savings,” she elaborated.

She further stated that the 20th anniversary, under the theme ‘Positioning Africa to Maximise the Future’, serves as a testament to CWG’s enduring contributions to the information, communication and technology sector throughout the past two decades.

“CWG has consistently set the standard for excellence in Africa and has diligently pursued its vision and mission, making a profound impact on Ghana and Africa’s digital ecosystems,” she added.

Business News of Wednesday, 20 September 2023

Source: thebftonline.com