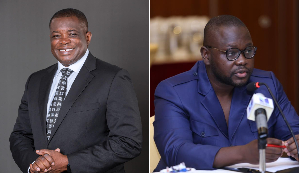

Dr. Jerry Kombat Monfant, President of MBIC Group, believes that the current economic crisis facing the economy should not solely be attributed to the COVID-19 pandemic but also factors such as the heavy reliance on natural resources.

Although he admitted to the economic challenges brought about by the virus, he said prior to it Ghana’s economy was weak and vulnerable – and that key indicators of an efficient economy such as gross national savings dipped from 24.19 percent in 2016 to 18.99 percent of GDP last year; an indication of how household income disposition has dwindled due to the poor status of the economy.

“The COVID-19 pandemic has brought a lot of economic challenges across the globe and is shaking the foundation of our economic resilience. Some countries are better-off in terms of resources and good planning. The same cannot be said about Ghana. Prior to the outbreak of COVID-19, Ghana’s economy was weak and vulnerable,” he said.

Buttressing his point on the economy remaining frail and vulnerable, he described the country’s economy as an inherited one which is dependent on the export of three natural gifts from God – oil and gas, cocoa and precious metals or stones – in their raw forms. And because none of these are manufactured by man, he said, it makes the economy susceptible to shocks.

A breakdown of Ghana’s main exports shows that whereas precious stones form about 35.64 percent of total export followed by oil and gas at about 30.61, cocoa constitutes around 19.01 percent. This, to him, makes the economy vulnerable to both internal and external shocks.

Meanwhile, even before the COVID-19-induced global economic crisis hit the country, oil – which is second on the list of the three top exportable products from Ghana – had seen its price fall to levels never seen in the 10-year production history of the country, as Saudi Arabia increased production of crude oil to 10 million barrels a day…flooding the world with more supplies and thereby pushing prices to all-time lows.

“Ghana’s forward Cocoa purchase agreement was executed six months or more before, and the major supply season was almost getting to an end before the outbreak of coronavirus in the country. I therefore disagree with the notion that COVID-19 is the only attributable cause of the country’s economic woes,” he told the B&FT.

He added: “Total expenditure for the COVID-19 is projected at 0.4 percent of GDP, which is not as much as 1.3 percent of GDP – being the cost of paying customers of the financial institutions whose licences were revoked in 2018-2019”.

On April 17, 2020 Moody’s investor services downgraded the country’s credit rating from B3 positive to B3 negative. To him, this is just a step away from junk; as it signifies a high risk of default and greater risk to investors or policy holders.

Explaining further, he said in 2019 Ghana’s debt to GDP was 64 percent – way above the international threshold of 60 percent. “Our debt to GDP was worse before the outbreak of COVID-19.

The US$3billion Eurobond issued by government in January 2020 constitutes 4.6 percent debt to our GDP; and the US$1billion disbursement under the IMF Rapid Credit Facility (RCF) also constitutes 1.5 percent debt of the country’s GDP.

“This puts Ghana’s total debt of GDP to 70 percent, pushing the country to Highly Indebted Poor Country (HIPC) levels.”

Again, citing an IMF report, he said the budget deficit has consistently widened from -7 percent in 2018 to -7.5 percent of GDP in 2019; a far cry from the overall fiscal ceiling of 5 percent of GDP set by the Public Financial Management Act (2016) and the Fiscal Responsibility Law (2018).

“This means that government is spending more when the economy is slowing in growth. And most of the country’s expenditure has been attributed to consumption in non-growth driven areas. For example, free education, NABCO, free meals and payments to customers of collapsed financial institutions,” he said.

Implications

Among the implications, he said the country is highly exposed to tightening funding conditions as a result of being vulnerable and persistent borrowing.

This, he warns, could lead the economy into a sovereign financial crisis. “Ghana is dying slowly, and we require urgent and better strategic options to revive the economy,” he lamented.

Business News of Thursday, 14 May 2020

Source: thebftonline.com