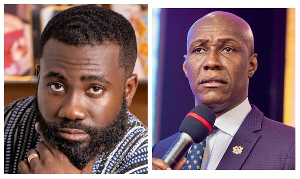

Former Deputy Minister of Finance and Member of Parliament for Cape Coast South, Kweku Ricketts- Hagan has said the current escalation in the depreciation of the cedi is as a result of the collapse of confidence in the financial sector and invariably the economy as a whole.

He said investors have lost confident in the economy because of the way the economy is being managed, especially the way the financial sector crises had been badly handled.

Speaking with TV3 at Parliament House on the 23rd December, before Parliament rose for the Christmas holidays, he said there is an unprecedented outflows of investor – capital from the economy, because people are not confidence in the economy and its future. So they don’t want to risk losing money by continuing to invest their capital here.

“Instead of people rolling over their bond investments at maturity to instil confidence in the economy, they are liquidating their investments and repatriating their capital due to the bleak future in the banking sector in particular, the financial sector in general and the economy as a whole.”

According to him there is a fundamental and historic problems with the cedi’s depreciation, which is not being addressed. These are the structural weaknesses in economy which continues to affect the stability of the cedi against major currencies. And if we do not restructure the economy, we will be in this perpetual cycle of weakening of the cedi against the major currencies, the dollar, the British pound, euro, etc.

He said Ghana is still predominately a commodity based economy, that imports too much and export very little, so the economy is constantly struggling with imbalances in its Balance of Payment (BOP), which widens the trade deficit and weakens the cedi through excess demand for dollars in particular and other major currencies. He warned that if these fundamental imbalances are not addressed there will be no ending in sight to the cedi’s depreciation.

He pointed out that there is also a historic problem to the depreciation story, in that when we redenominated the cedi in 2007 and pegged the new overvalued cedi to the dollar (1new cedi was equivalent to $1), it was not backed by a strong economy.

The cedi has since been struggling against the dollar and the other major currencies to find its true level. Since 2007 to 2019, the cedi has depreciated against the dollar by 470% that is on the average 39% depreciation year-on- year. This he said is the legacy of false hope that was imposed on us when the redenomination was done.

“The last straw is the recent injection of the new 100 and the 200 notes, which was introduced into the economy unnecessary and has increased the money supply. This excess money dubiously in circulation is further depreciating the cedi.”

Business News of Saturday, 28 December 2019

Source: Alhaji Saani