The Chief Executive Officer of First Bank of Nigeria Limited, parent of FBNBank Ghana, Dr. Adesola Adeduntan has underscored the need for banks in Africa to innovate in order to derive maximum benefits from the new wave of digitization enveloping the banking industry. Areas such as “big data and analytics, virtualization/tokenization of payment cards, digitalization of lifestyle needs, block chain technology and Artificial Intelligence/Robotics present enormous opportunities for banks to increase their growth targets and must thus be focal areas for banks on the continent” according to Dr. Adeduntan.

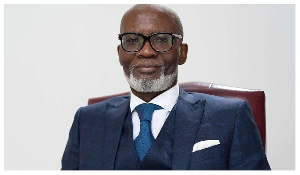

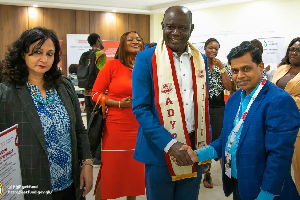

Speaking on the topic: Integrated Digital Banking Ecology: Opportunities and Challenges at the recently-held Digital Banking Summit in Accra, Chuma Ezirim, the Group Head, e-Business & Products at First Bank of Nigeria Limited who spoke on behalf of Dr. Adeduntan suggested that players in the industry needed to develop their digital strategies on the back of three key pillars namely “Resilience, Renewal and Reinvention.”

Shedding some light on this, Chuma Ezirim said banks needed to launch a holistic strategy in six key areas aligned to their digital strategies in order to develop a resilient digital framework. These areas included “rethinking customer engagement and marketing, journey streamlining and digitization value creation through data analytics and infrastructure and architecture modernization.” He added that other areas banks needed to look at were being “agile at scale as well as organization, talent, culture and partnership” he added.

In the area of renewal, he highlighted the need for banks to “build world class capabilities in areas, where banks had historically under-invested.” These areas were “Data-driven Digital Insights, Integrated Customer Experience, Digital Marketing, Digitally Enabled Operations, and Next-Generation Technology among others” Chuma said.

Whilst building a resilience and renewing capabilities in their operations, Chuma underlined the importance of the third leg of the strategy for banks, that is, ‘reinvention’ which essentially calls for efforts for management of banks to “think beyond the bank’s boundaries.” This, he said, implied bankers “thinking of all the things that banks do not do, but are part of a customer’s financial life – whether a person or a business.” Such things as seeing “banking as a Service, electronification of Lifestyle Needs (Uberization of Banking), and partnering beyond payments” he said.

First Bank currently leads in electronic payment services adoption in Nigeria with the bank having issued over 10 million Cards and processing over 30 percent of Card Transactions in Nigeria for instance. The bank also boasts of controlling over 17 percent market share of the ATM Network in Nigeria having deployed over 2,900 ATMs across the country. The bank was also the first to implement Instant Card and PIN issuance and these among other things had culminated in the bank being recognized and rewarded with the MasterCard International award for innovation in 2014 among others.

First Bank of Nigeria Limited is the parent bank of FBNBank Ghana Limited. FirstBank operates an extensive distribution network with over 750 business locations (623 branches, 61 quick service points and 69 cash centers/agencies), over 2,500 ATM’s and over 19 million customer accounts. The Bank provides a comprehensive range of financial services and has international presence through its subsidiaries, FBNBank (UK) Limited in London and Paris, FBNBank DR Congo, FBNBank Ghana, FBNBank Gambia, FBNBank Guinea, FBNBank Sierra-Leone and FBNBank Senegal as well as its Representative Office in Beijing, China.

Business News of Thursday, 29 August 2019

Source: FBN Bank