The GCB Bank Limited will soon outdoor a mobile wallet soon to increase its access to funds outside the formal banking sector.

The move forms part of the bank’s 2018 to 2022 digital transformation agenda being pursued as part of its business strategy to accelerate growth through the provision of first-class banking solutions for customers and optimizing value for shareholders.

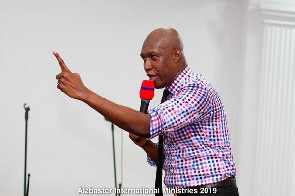

Mr Jude Kofi Arthur, Chairman of the Board of Directors of the bank, who announced this at the bank’s 25th Annual General Meeting on Friday, said the mobile wallet in the offing had a refreshing focus.

He said the contemporary state of the art and strategic capacity of telcos provides an absorption capacity of customers, albeit at the rudimentary levels.

“Our strategy is to focus on developing creative strategies to rope in and transition these new entrants into the higher levels of financial pyramid by offering a wide array of financial services and opportunities over time, “he said.

The bank, he said, would view the telcos differently as potential partners at different ends of the banking spectrum, adding that, their presence would accelerate cash transactions from the informal to the formal banking sector to fuel the growth of new financial consumers that were best positioned to be served.

With these digital agenda, Mr Arthur expressed the optimisim that the bank would achieve process optimization, cost efficiency, governance and risk management, talent and performance management, resulting in customer satisfaction.

Touching on the major success of the bank, he said the bank declared a dividend of 30 pesewas per share, amounting to GH¢ 79.50 million for the 2018 fiscal year.

Mr Arthur said the banks’ profit before tax increased by 35.6 per cent to GH¢450.17 million in 2018 from GH¢331.98 million in 2017.

The impressive profit performance of the bank, the Chairman explained, was driven by solid revenue growth.

Mr Arthur said the banks’ net interest income went up by eight per cent, from GH¢895.31 million to GH¢967.10 million.

He said the net trading income also went up by 121 per cent to GH¢90.64 million from GH¢41.02 million whilst net fees and commission income increased by 16 per cent to GH¢197.60 million from GH¢170.30 million.

Mr Arthur said the banks’ performance enabled it to be among the top three most profitable Banks in the industry for 2018.

The banks’ assets, he stated, recorded a growth of 11.4 per cent from GH¢ 9.63 billion in 2017 to GH¢ 10.72 billion in 2018.

“Total deposits also went up by 19.6 percent to GH¢ 8.30 billion in 2018 from GH¢ 6.92 billion in 2017. This made GCB the number one Bank in deposit and asset size in the industry,” he said.

“The Bank’s equity recorded a growth of 19.4 per cent from GH¢1.21 billion in 2017 to GH¢1.45 billion in 2018. Earnings per share increased by 38.2 per cent from GH¢0.89 to GH¢1.23.”

Despite the sterling performance, the Chairman said the high cost of operations continued to be a major challenge for the Bank and that adequate measures had been put in place to ensure that the cost-to-income ratio reduced.

Mr Samson Ashon, a shareholder commended the managers of the bank for setting up training for its workers and suggested that the training centre be commercialised to generate money for the bank.

Business News of Saturday, 1 June 2019

Source: GNA