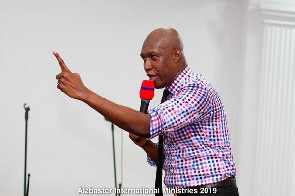

A former CEO of the Ghana National Petroleum Corporation (GNPC), Mr Alex Mould, has said anybody who approves the oil deal between the government of Ghana and Aker Energy as it stands is “useless”.

Speaking at a forum organised by the Caucus for Democratic Governance – Ghana, on Tuesday, 7 May 2019, in connection with Ghana’s stake and interest in the Deepwater Tano Cape Three Points (DWT/CTP) oil block operated by Aker Energy Ghana Limited, of which policy think Imani Africa recently said the country risked losing $30 billion if the firm’s Plan for Development and Operation (PDO) were not reviewed, Mr Mould said: “Aker is now telling us that they have spent $1.2 billion in developing the field, when we know that they only paid $100 million. So, if we approve this $1.2 billion as pre-development cost and we add it to the development cost, Aker is going to make – based on [the] 50 per cent it owns – a windfall profit of almost $500 million for doing nothing”.

“That means that they paid $100 million, they say they paid $1.2 billion, 50 per cent of it is $600 million, you allow them to put $600 million as cost oil, for the $100 million that they have spent, they’ll recoup $500 million on the citizens of this country. Anybody who understands an iota of finance in this country, and the Finance Minister understands finance, he will not approve such a thing to happen”, Mr Mould said.

He continued: “Anybody who approves this, this is a financial loss to the state, and we should be very careful when we are, as custodians of the state’s resources, allowing such things to happen. And it only points to one direction: if anybody approves this, it’s either he is useless and doesn’t understand the basics of financing or there is state capture”.

Aker recently said that it has concluded its appraisal drilling campaign offshore Ghana and currently working on a revised Plan for Development and Operations (PDO), following a scheduled feedback from the Ghanaian authorities.

“Based on close collaboration with the Ghanaian authorities, regulators and our licensed partners, Aker Energy submitted an application for approval of a comprehensive development plan with the objective of maximising oil recovery in the DWT/CTP area and ultimately unlocking significant potential value for the People of Ghana.

“We appreciate the ongoing constructive and transparent dialogue with the Ghanaian authorities and the feedback we now have received is an important and natural part of the approval process. We are currently updating the application with an ambition to get the formal approval ahead of our final investment decision, allowing us to commence execution of this promising development project,” said Jan Arve Haugan, CEO of Aker Energy.

Furthermore, Aker Energy said it commenced the appraisal drilling in the DWT/CTP block offshore Ghana in November 2018, which led to the submission of an integrated Plan of Development and Operations (PDO) on 28 March.

The drilling campaign has now been concluded, the statement said, adding that the purpose of the appraisal campaign was to verify the partners’ understanding of the area and to prop up additional resources to further strengthen the Pecan field development.

The recent appraisal drilling campaign involved three appraisal wells and a side-track well, Aker Energy said.

“The appraisal wells have provided valuable information for us to further optimise the area development plan in the DWT/CTP block. We remain committed to continue developing the petroleum resources in the area in a way that will deliver value to the people of Ghana and to us and our partners,” said Mr. Haugan.

Pecan-4A and Pecan South, the first and second wells in the appraisal campaign, identified deep oil/water contact and confirmed the partners’ geological model, as previously announced.

A side-track well to Pecan South was initiated to verify the volume potential of Pecan South by testing a deeper part of the structure. The sidetrack well encountered oil shows, but no recoverable resources due to a tight reservoir. Based on preliminary data analysis, it is estimated that between 5 and 15 million barrels of oil equivalent (mmboe) could be added to the Pecan field development from Pecan South.

Aker Energy has also completed a well in Pecan South East, the third well in the appraisal campaign. The well encountered oil in a thin upper sand. The partners will now assess the data gathered from the well to evaluate whether the accumulation could be tied-in to the Pecan field development.

Once the Plan for Development and Operation has been agreed with the authorities, Aker Energy estimates that first oil from the Pecan field could be produced 35 months after the final investment decision (FID).

Reserves to be developed in the first phase are estimated at 334 million barrels of oil.

Discovered contingent resources to be developed in subsequent phases are estimated at 110-210 mmboe, resulting in a combined volume base of approximately 450–550 mmboe.

These estimates exclude any additional volumes from Pecan South and Pecan South East currently being assessed.

The partners have identified further upsides in the area that they intend to mature as part of the area development.

Aker Energy said it believes that the total resource potential in the area is still within the range of 600-1000 mmboe, as earlier communicated.

Aker Energy Ghana Limited is the operator under the DWT/CTP Petroleum Agreement with a 50% participating interest. Its partners are Lukoil Overseas Ghana Tano Limited (38%), the Ghana National Petroleum Corporation (GNPC) (10%) and Fueltrade Limited (2%).

Business News of Wednesday, 8 May 2019

Source: classfmonline.com