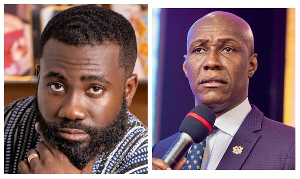

Ghanaian businesses have no option but to become abreast with the changing times, in tandem with the world of digitization, Chief Executive Officer of BOND Savings and Loans Plc, Mr. George Ofosuhene has indicated.

Technology, the renowned banker and entrepreneur notes has literally changed every aspect of the way any business operates and “never before in history has that change occurred so fast; it is now the key driver.”

Financial inter-mediation under disruption

According to the BOND CEO, in Ghana, one area that has significantly felt the impact of technology has been financial inter-mediation and that is only on the payments and settlements side.

The contribution of technology to the achievement of a cashless or cash-light society cannot be overemphasized.

Mobile Money has become the order of the day and the rise of FinTechs has disrupted the way banking is conducted.

Statistics from the Bank of Ghana indicate that;

• 52.86 per cent growth in 2018 alone in terms volume of mobile money transactions moving from 428m transactions in 2017 to 655m transaction in 2018.

• Value of transactions moved from GH?68billion in June 2017 to GH¢104 billion in June 2018 representing 53.31 percent growth.

• Registered mobile money accounts as at June 2018 was 29.9m probably more than Ghana’s population.

“To say that technology is evolving will be an understatement, technology is actually galloping. In this century, it is not how much we think technology can improve one’s business, but the broader issue is whether it is possible to conduct business without relying heavily on technology,” he points out.

On the score of businesses welcoming technology as a major part of their operations, Mr. Ofosuhene assured customers and clients of BOND that the company would continue to improve on internet and technology related products and services.

BOND’s internet banking platform gives customers the benefit of banking from wherever they are located.

They have unlimited access to their accounts, as they could view their account activities, check loan and investment statements, transfer funds from one BOND account to another, all under a well secured platform, to ensure your financial protection.

The BOND Mobile Banking App, brings the banking experience through the smartphone of the customer.

Every transaction and banking activity, available via the internet banking platform is available to users on the App.

BOND continues to roll out through its e-banking platform, products and services that guarantee the ease of making bill payments, mobile money transfers, and airtime top ups.

Business News of Sunday, 21 October 2018

Source: thefinderonline.com