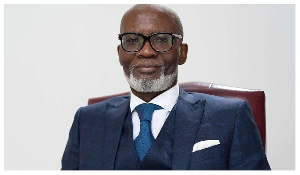

Groupe Nduom CEO Dr Papa Kwesi Nduom has said through his rounds across the country to learn at first-hand why customers of banks and other financial institutions are panic-withdrawing, “The people pointed to Menzgold and other public quarrels between financial institutions and regulators and recalled the DKM saga (especially those in the three regions up north and Brong Ahafo) and decided, ‘not this time’, and ran to get their monies”.

Below are the 8 things Dr Nduom, who owns GN Bank and Gold Coast Fund Management, investment firm, said he learnt on his mission:

What I’ve learnt asking for support for local banks

1. Communication is the key to solving problems. Yes, that simple. Human touch, face to face talking to customers and people in general was missing. People appreciated my presence and will like others especially those in authority to go to the people and talk to them in person.

2. The people know what is going on. The traditional media, social media, word of mouth has spread every challenge the microfinance, rural banks, savings and loan companies, banks and investment houses have been going through and the people have been scared, worried they would lose their savings and investments. Which means we need the same media to calm people’s fears.

3. When the five banks were consolidated, the panic was heightened. The more bad news people heard about wrong doing just made matters worse. ALL Ghanaian owned banks were painted the same - avoid them, go and get your money. Even though no depositor lost any money, they did not hear from anyone in authority say that “Your money is safe”. So they stuck to their instincts and kept running for their monies.

4. The people pointed to the Menzgold and other public quarrels between financial institutions and regulators and recalled the DKM saga (especially those in the three regions up north and Brong Ahafo) and decided “not this time” and ran to get their monies.

5. Basic banking and investment education and using Matthew Chapter 25, the Parable of the Talent to teach those who came to hear us that funds are invested; and that the good companies do not dig holes in the ground to bury deposits; that most funds are given out as loans and investments was key. They asked “why didn’t you come earlier?” And, “the authorities must do the same”

6. I was touched by the recognition that GN Bank is not a regular bank but a special, national retail one appreciated by those previously unbanked in the smaller towns. They knew that It is the one in many towns other banks can’t or don’t want to go. So it has developed a unique clientele who have come to rely on it for safe keeping and transfers of their monies.

Wechiaw, Tumu, Wa, Nandom, Nadowli, Gwollu; Tempane, Widana, Paga, Navrongo, Bolga; Walewale, Savelugu, Karaga, Saboba, Tamale, Yendi; Kintampo, Ejura, Techiman, Kwame Danso, Wenchi, Chiraa, Goaso; Bogoso, Prestea, Akontombra; Ayanfuri, Dunkwa, Asebu, Anomabo, Mankessim; Djemeni, Kpassa, and many, many more.

7. Many, many small businesses have expanded their reach to other towns and regions because GN Bank offers them the ability for their customers to deposit monies into their accounts. These businesses sought private meetings with me to seek assurances from me that the bank will stay and work with them. We have been able to solve problem for businesses such as Wemah Enterprises in Walewale and offered them a good way forward.

8. When I demonstrated the link between the average 21 out of 100 people who take loans and do not pay back; debts owed by government in billions that over the years take a long time to be paid; bank management who do play by the rules; regulators who wait to wrongdoing to happen before they strike hard; to the liquidity and credibility challenge experienced; a clear light was shined in people’s minds.

Truly, a number of bank and investment company clients have suffered these past two months - emotional stress and liquidity - lack of cash and poor customer service. WE MUST SOLVE THESE PROBLEMS.

I will follow up with some of the people I met on this Tour, ten regions in two weeks, to find out if we have made any positive impact at all.

To be continued...

Business News of Monday, 15 October 2018

Source: classfmonline.com