Former staff of UT and Capital Banks have called on the Bank of Ghana (BoG) and PwC—the officially appointed Receiver after revocation of the two banks licences in August 2017, due to severe impairment of capital, to pay their agreed exit package.

The two collapsed banks had a combined staff of about 1000, of which 650 have been laid-off. GCB, under a purchase and assumption agreement, was only able to employ about 350 ex-workers of UT and Capital banks.

The staff who were laid-off received one month salary from GCB – an act that was more on humanitarian grounds since it was receivership and GCB had no obligation to the staff.

B&FT sources say the severance package agreed between UNICOF and the Receiver, on behalf of the ex-staff, was 2.5months salary multiplied by the number of years a staff has worked.

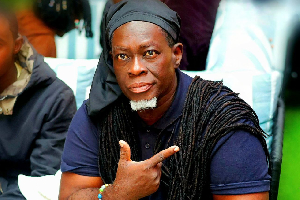

Edem Adimado, one of the leaders of the group, at a press conference in Accra said: “It has been eight agonising months since our banks collapsed, and we have kept our mouths shut in the hope that the Bank of Ghana and government by extension would seek our interests. We genuinely believed that we would not be left this worse-off.

“It’s unfortunate that eight months down the line we have not received our Exit Pay; the majority of us are jobless, and the few who were lucky to have been employed by GCB Bank are also worse-off in terms of remuneration.”

He indicated that their End of Service Benefit, which they contributed from their own salaries on monthly basis and was invested on their behalf by CBL Investments, has still not being paid despite instructions by the Joint Receivers to pay.

“As per the Joint Receivers’ letter dated 15th January, 2018, an agreement was reached with UNICOF, our representatives, to pay all staff of these defunct banks an Exit Package. However, nothing has been paid to staff. We are therefore appealing for all entitlements to be paid us as a matter of urgency.”

Ex-employee loans and other matters

Mr. Adimado said loans advanced to the ex-staff should be discounted to enable them meet their payment obligations to the Receiver.

“To meet personal obligations, employees were also given some loans. As per basic rules governing credit, our staff loans were taken for a specific tenure. However, these extraneous circumstances have contrived to truncate the tenure and also deprive us of our livelihood. As responsible citizens and bankers, we are mindful of our obligations – and as such, we are rightfully asking for our loans to be discounted so we can discharge our obligations to the Receiver.

“Finally, many of us had outstanding leave-days – and as per the Labour Act 2003, sections 25 and 26, we are requesting for all outstanding leave to be computed and paid for.”

Petition to government

The ex-staff indicated their preparedness to formally petition the Presidency. “We will send a formal petition to the Presidency, and we are hopeful that government will listen to our plight and come to our aid.

“As we stated in our maiden press release, we believe the laws governing liquidation in Ghana deserves a critical rethink; because the current status leaves employees very vulnerable and dispensable. Even though we are only a very small fly in the scheme of things, we believe that we are fighting for posterity by bringing the plight of workers during liquidation to the forefront.”

Business News of Wednesday, 9 May 2018

Source: thebftonline.com