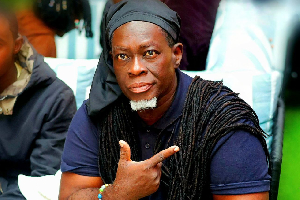

The President of the Ghana National Chamber of Commerce and Industry (GNCCI), Nana Appiagyei Dankawoso I, has called on commercial banks to reduce their lending rates to reflect the recent cut in the Bank of Ghana’s policy rate.

The Monetary Policy Committee (MPC) of the Bank of Ghana, last week, reduced its policy rate by 200 basis points to bring the policy rate down to 18 percent, the lowest in the last 36months.

The GNCCI, according Nana Dankawoso I, is keen to see that commercial banks respond accordingly by also cutting their rates of lending to businesses which will cut the cost of doing business in the country and enable growth and job creation.

In an interview with the B&FT, Nana Appiagyei Dankawoso I, said access to cheap credit is fundamental to the growth and development of businesses, particularly SMEs and start-ups, which are encouraged by low-interest rates to increase their level of investments over a certain period of time.

“It is for this reason that the Chamber gladly welcomes the Bank of Ghana’s 200 basis points reduction in the monetary policy rate to 18% on 26th March 2018 following the investment-led recovery at the domestic and international fronts. However, the lagged effect of the reduction in the monetary policy rate, which reflects the cost of banking and efficiency in the banking sector, is a major concern to the private sector.

Ghana is noted with the highest banking lending rate (35.5%) in Africa and second to Brazil (55.06%) in the world according to Trading Economics. Businesses are compelled to access short-term credit with high-interest rates for their long-term investment.

We cannot continue undermining the competitiveness of these businesses and eroding their profits with high interest rates. It is the Chamber’s express view that the goodwill demonstrated by the Bank of Ghana will be reciprocated by the commercial banks.”

The cut in the policy rate which is the biggest drop since November 2014, according to the Governor of the Bank of Ghana, Dr. Ernest Addison was influenced by positive economic outlook.

Dr. Addison addressing the media after the bank’s 81st regular meeting of the Monetary Policy Committee (MPC) in Accra, said the decision is based on the central bank’s moves to achieve the annual inflation target.

This comes to confirm projections by industry watchers and analysts that the Monetary Policy Committee (MPC) of the Bank of Ghana was likely to reduce the policy rate at its next meeting considering the gains made in the economy.

Policy rate is the rate at which the central bank lends to commercial banks for onward lending to the general public and institutions who are their customers.

Nana Appiagyei Dankawoso I, however, added that the Bank of Ghana should expedite action on the passage of the Ghana Bank’s Reference Rate.

“The coming on board of the Ghana Reference Rate in April 2018 should help address the persistent high sticky interest rates in the country. The need for improved access to long-term funds cannot be overemphasised in the wake of intense business competition.”

Introduction of the Ghana Bank’s Reference Rate (GBRR) to replace banks setting their own base rates is expected to increase transparency in credit lending and enhance the transmission between the Central Bank Rate and banks’ lending rates.

It will be calculated as the weighted average of the central bank rate and the weighted 2 month moving average of the 91-day Treasury bill rates” and should be adjusted every six months barring any extreme conditions in the markets.

Business News of Wednesday, 4 April 2018

Source: thebftonline.com