Ghana’s financial sector remains liquid and solvent, Dr. Christian Ahortor, Research Department, Bank of Ghana (BoG) has noted.

Speaking at a Roundtable discussion organised by the Policy Initiatives for Economic Development, an economic think tank in Accra this week, Dr. Ahortor observed that total asset base of banks increased to GH¢89.1 billion in July 2017, representing an annual growth of 32.9 percent compared to24.6 growth a year earlier.

“The growth in assets was funded largely by domestic deposits which went up by 32 percent on a year-on-year basis. The industry’s Capital Adequacy Ratio (CAR) averaged 14.3 percent at the end of August 2017, above the 10.0 percent statutory threshold”.

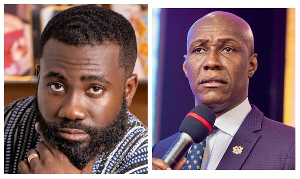

Dr. Ahortor represented the Governor of the BoG, Dr. Ernest Addison, when he spoke on the topic- “Ghana’s Financial Sector: Emerging Issues, Challenges and the Way Forward” at the roundtable. However, he conceded that there are some notable challenges to effective intermediation of the banking system.

These, he notes, include non-performing loans (NPLs) and concentrated risks, the high exposure of the banking system to the energy sector which he said is partly to blame for the high NPLS which reflect the high risk premium that feeds into high lending rates of banks.

Another challenge he noted is the slow pace credit expansion in response to the policy easing which he said can be partly explained by the high NPLs mentioned earlier, and effective risk management and corporate governance are other challenges.

Daniel Amateye Anim-Prempeh, Executive Director of Policy Initiatives for Economic Development noted that the recent development in the banking sector demands the organization of the roundtable discussion so that participants can recommend strategies necessary to develop a robust and resilient financial industry capable to stimulate economic activities as well as propel economic growth and development.

“More importantly, we want to see our indigenous banks growing to become a vehicle which can give out loans to support huge medium and long term investment and infrastructure projects within the domestic economy as well as the entire continent of Africa”, Anim-Prempeh said.

He said Policy Initiatives for Economic Development is a newly established economic policy think tank with the sole aim to creating the necessary platform for professionals, experts and consultants to meet and discuss, analyze and provide alternative, yet credible policy directions to government and the business community.

Dr. Ahortor appreciated that pertaining to the new minimum capital requirement, people are concerned that many local banks may not meet the deadline by the target date, and entertain the fear of being swallowed up by foreign banks.

He said banks would be required to meet the new requirement through fresh capital injection, capitalization of income surplus, or a combination of fresh capital injection and capitalization of income surplus.

“Local banks can strategically position themselves, or go to the open market, that is, the stock exchange. By so doing, Ghanaians will also benefit from the profits of the banks. Bog is ready to guide the process”, he added.

Dr. Ahortor mentioned that the Bank is taking its regulatory and supervision functions seriously to ensure the banking system is sanitized for efficient and effective financial intermediation.

“The on-going recapitalization and the implementation of Basel II and III are intended to deal with some of these challenges”.

He said government commitment to float GH¢10 billion energy bonds and the implementation of the ESLA account will also help in defraying the energy sector indebtedness to the banking sector, and this will help bring down the high NPLs.

Business News of Friday, 29 September 2017

Source: thebftonline.com